Here are some things I think I am thinking about:

1) Bye Bye Bye BBB.

It looks like Build Back Better is getting nuked. Or, at a minimum, reduced.

I haven’t talked about this bill that much because I didn’t think it was a hugely important short-term economic driver. To put things in perspective, it was estimated to add $150-200B to the deficit in the next few years. The spending was drawn out over 10 years so even though the trillion $+ bill sounds big it was relatively small when broken up over 10 years. For comparison, we ran $3T+ deficits each of the last few years. This bill was not moving the needle all that much in comparison to recent policy that I said was inflationary.

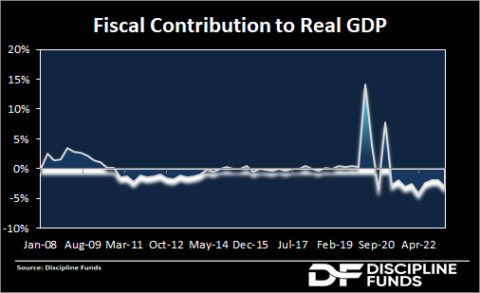

That’s actually part of what makes its demise somewhat shocking. Reports say that Joe Manchin has been getting a lot of pushback from constituents about inflation. And so any and all  government spending is coming under increased scrutiny. I totally get it. And it should move the inflation needle lower a bit in the coming years. My estimate is that it will detract about 0.5% from GDP in the coming 12 months. Which is pretty interesting because fiscal policy was already going to detract from future growth. It’s going to be really interesting to see how 2022 plays out. With the end of unemployment benefits, end of the child tax credit early next year, student loan repayments starting up and now the end of BBB we might see a bit stronger disinflation than some people expect.

government spending is coming under increased scrutiny. I totally get it. And it should move the inflation needle lower a bit in the coming years. My estimate is that it will detract about 0.5% from GDP in the coming 12 months. Which is pretty interesting because fiscal policy was already going to detract from future growth. It’s going to be really interesting to see how 2022 plays out. With the end of unemployment benefits, end of the child tax credit early next year, student loan repayments starting up and now the end of BBB we might see a bit stronger disinflation than some people expect.

2) The ARK Overflowed last year.

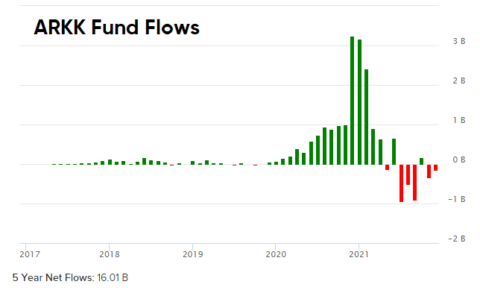

I really like Cathie Wood. I think her ETFs are thoughtful and interesting. I’m obviously not a big advocate of stock picking and higher fee active management, but whatever. Her funds have done  great. You can’t knock them. Unfortunately the money weighted returns have been dreadful because, just like picking stocks, picking the best manager is hard. And people tend to chase performance. So, here we have a case where investors piled into ARKK after it did really well.

great. You can’t knock them. Unfortunately the money weighted returns have been dreadful because, just like picking stocks, picking the best manager is hard. And people tend to chase performance. So, here we have a case where investors piled into ARKK after it did really well.

Unsurprisingly, people who chase returns are usually just chasing risk. And so they were piling into what had actually become a riskier vehicle after its underlying securities had generated their huge returns. And now the fund is down 22% this year.

This isn’t a knock on Cathie. She can’t control the fund flows. It’s just an observation about investor psychology and how we tend to see the same trends play out time and time again. Investors always think the grass is greener somewhere else and constantly chase returns. It’s why I’ve become such a big advocate of Discipline Based Investing over the years. The adequate strategy that you stay disciplined to will likely generate better returns than trying to constantly chase the perfect strategy.

3) Turkey gets the MMT treatment.

Regular readers are probably familiar with my relationship with Modern Monetary Theory. I like some of what they say and I think they go too far on other things. MMT’s become popular in recent years after Stephanie Kelton published The Deficit Myth. The book says a lot of the same things I say about how a government can’t run out of money. But MMTers take that idea to a policy extreme and advocate for huge government programs like a federal Job Guarantee. My long running criticism of that idea is that I don’t know how you can control inflation if you’re running what is essentially a perpetual procyclical government policy approach all the time. I am personally more sympathetic to a more traditional Keynesian countercyclical approach. That is, the government should tighten policy when things are overheating and support the economy when things are cooling off too much.

Things got real interesting with MMT in the last few weeks as Turkey’s currency imploded. What’s interesting about it is that Warren Mosler, MMT’s founder, had recommended interest rate cuts  to “firm the Lira”. And Turkey seemed to be listening because they cut rates within a few days of that. And each rate cut caused the Lira to collapse. Within a few months the currency had imploded -50%. It’s not just a downturn. It’s a total meltdown.

to “firm the Lira”. And Turkey seemed to be listening because they cut rates within a few days of that. And each rate cut caused the Lira to collapse. Within a few months the currency had imploded -50%. It’s not just a downturn. It’s a total meltdown.

It validates one of my long running criticisms of MMT – what is their inflation control policy? I haven’t seen a single MMT advocate call for countercyclical fiscal policy, ever. Not even during 2021 when inflation is raging around the world. And they seem to get interest rate policy exactly backwards. So what’s left? They love price controls, but price controls are well founded to work only with other broader policies. And their federal Job Guarantee would exacerbate inflation in a place like Turkey because the unemployment rate is high and it would add to the deficit in addition to putting a floor under wages. So what’s left for them to control inflation?

It all begs the question – MMT has all these great ideas for huge procyclical government policies, but how will they control inflation when it actually comes? Because so far, the real-time track record does not look good.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.