Some wide ranging thoughts on a slow Monday….

1) Don’t default on your student loans after getting three degrees you don’t need!

I don’t know if you saw this NY Times article that ran over the weekend, but here’s the basic gist of it. Lee Siegel, a freelance writer says that he defaulted on his student loans. He notes that his family couldn’t afford to send him to the schools of his choosing and he felt that paying the loans back, when he couldn’t afford them, would infringe on what he wanted to do in life (writing, instead of using his degree to pay for his loans by doing a higher paying job he didn’t like quite as much). And he strongly urges today’s youth to consider the same path. But he left out a minor (and by minor, I mean major) detail – he got THREE degrees from Columbia.

According to Slate’s Jordan Weissmann, Lee Siegel got three degrees from Ivy League school Columbia (which, I think it’s safe to assume, he paid for via student loans). Columbia just so happens to be one of the best and most expensive schools in the world. And he got a Bachelor of Arts, a Masters in Arts AND for good measure, he went back and got a Masters in Philosophy. Then, when he decided that getting three degrees to become a writer, was a very silly decision, he decided he didn’t want to pay for all those loans. This point is never explicitly noted in the NY Times article. Instead, it reads like some poor college kid couldn’t afford to go to college and decided to default on his loans because it didn’t make financial sense. I actually came away from the original article feeling sympathetic, but these new details change the whole story. Basically, what Siegel did was stupid and irresponsible. And he decided he didn’t want to be responsible for those stupid and irresponsible decisions. And now the NY Times is passing this off as sound financial advice.

I don’t get easily irritated, but I have to say that this one really annoys me. What Lee Siegel did is the equivalent of eating at the buffet, going back for seconds, then taking enough food to survive for life and then deciding that you just don’t want to pay for all that food. Look, I am very sympathetic to students with high amounts of student loans and I am very open-minded about public funding of education, but Siegel essentially made a series of very bad financial decisions (obtaining three expensive & unnecessary degrees to become a writer), reaped the benefits of the degrees and then decided he didn’t want to pay for it. And then he implies that today’s students should follow his lead! Yes, go out there youngans and get degrees you don’t need, can’t afford and then just default on them! That’s just financially, morally and socially bankrupt in every way.

And yes, I agree with Jordan that the NY Times should run an apology article noting how irresponsible and misleading their article was.

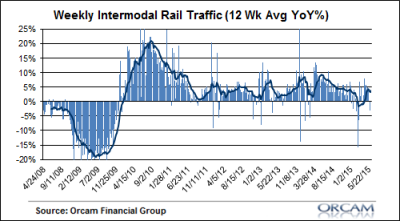

2) Rail traffic is still humming along.

I get a lot of inquiries about my old rail traffic updates. I used to post this every week, but I just got too busy to keep up with it in the last year. I still track it, but not quite as diligently. Anyway, here’s an update.

After a brief dip into negative territory due to the oil price collapse, it looks like rail traffic has rebounded quite a bit. The latest 12 week moving average in intermodal traffic is 3.65%. That’s well below the 2014 levels, but more in-line with the average rate of change that we saw since 2011 (4.5%). So, not good and not great. Kind of like the broader economy.

3) The oil price decline will be modestly beneficial?

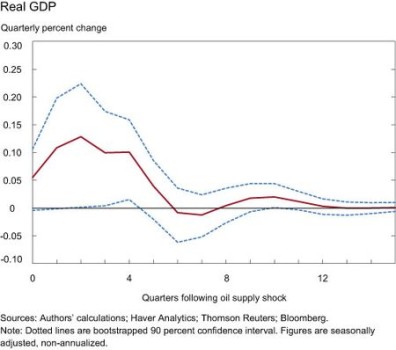

The NY Fed has a good post on the impact of the decline in oil prices on the US economy. This has been a two sided debate between those who said the oil price decline would positively impact the economy and those who said the price decline was a sign of something very bad lurking underneath. But the NY Fed seems to imply that both sides are basically wrong.

The real question in this debate was whether this was a demand side shock (like 2008) or if it was mostly a supply side shock. If it was a demand side shock then prices are declining because the economy is very weak. If, on the other hand, this was a supply side shock, then it could just mean that prices were artificially high and OPEC is targeting a lower price in the effort of removing some of the future shale competitors from the markets (which would imply that this decline is temporary and not so much a sign of a weak economy).

But maybe it’s a lot more of both than we thought and the impact is relatively minimal. According to the NY Fed, the oil price decline will have only a very modest positive impact on GDP:

So, maybe both sides are wrong in this debate. Maybe the oil price decline was a bit of a demand side shock and a bit of a supply side shock. And the result is a relatively meager impact on overall growth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.