I’m pretty sure I think all of these things. Let me know what you think you think about the things I think I think.

1) On Piketty and R > G. I was doing some more thinking on Piketty and his idea that the problem of inequality is ultimately about the way that wealth concentrates into the hands of a few people primarily due to inheritance. But how true is this of the world we actually live in? For instance, if you look at the Forbes 400 list of richest Americans the list is a revolving door of names (including last names). The list in the 80’s looks nothing like the list in 2013. And perhaps more importantly, there’s actually an increasing trend in upward mobility in this list (via Kaplan and Rauh):

“in the U.S., the share of Forbes 400 individuals who are the first generation in their family to run their businesses has risen dramatically from 40% in 1982 to 69% in 2011. Figure 2 illustrates that the percent that grew up wealthy fell from 60% to 32% while the percent that grew up with some money in the family rose by a similar amount. The share that grew up poor remained constant at roughly 20%. The Forbes 400 of recent years therefore did not grow up nearly as advantaged as those in decades past. Those who grew up with some wealth in the family were far more likely to start their own businesses rather than inherit family businesses. Furthermore, these findings about generation and wealth in the family are very similar when the results are weighted by wealth. These results suggest that there has been an increase, not a decrease, in wealth mobility at the very top.”

This doesn’t mesh well with the concepts and conclusions that Piketty cites in his book. Now, it doesn’t mean inequality isn’t a problem, but it does mean that the inequality argument is not always being framed correctly.

2) John Hussman discussed what he called the “Iron Law of Valuation” in this week’s letter. Hussman says that the market is overvalued and that investors are not properly positioned for the potential relapse. As regulars will know, I am not a big fan of trying to claim that the market is worth “this much”, and investors think it’s worth “this much” therefore you need to be bullish or bearish. The whole concept of “value” appears nebulous to me.

So, I’d introduce the Iron Law of Behavioral Finance – the market can remain irrational longer than you can remain solvent. You might very well know the true “value” of the market at present. You might have some software or indicator that tells you precisely what the market is worth. But if the rest of the market doesn’t agree with you then your concept of value is 100% useless.

And this is the flaw in so many value approaches. While many of them reject concepts like rational expectations or the efficient market hypothesis, they implicitly embrace these views by assuming that their own view is the rational view and that that market will eventually come around to it. I reject these views and embrace the idea that the market is filled with irrational people and more often than not, understanding the market and protecting yourself within it is about protecting yourself from the madness of the crowd rather than trying to predict what it’s thinking at any given time. Or worse, waiting and hoping that this mad crowd will one day agree with your idea of what is or isn’t “valuable”….

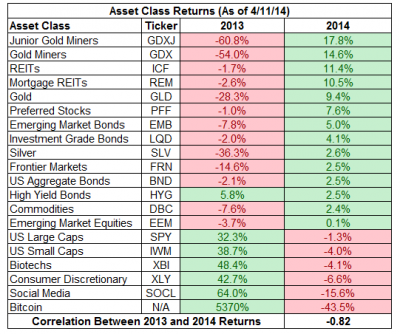

3) I loved this chart from the guys over at Pension Partners showing the contrast between 2013 and 2014 asset price performance. It’s well known that recency bias tends to lead us off the cliff of focusing excessively on recent performance. Study after study has shown that our obsession with the recent past leads us to chase returns and chase the “hot hand” or the hot manager. And time and time again this proves to be a losing battle as recent winners are often just riding a wave that is more likely cresting than surging higher. It meshes well with the growing importance of behavioral finance in portfolio management. Beware of high flyers and the hot hand. What worked in the recent past isn’t necessarily a sign of what’s going to work in the future.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.