There is a persistent concern about recession in the current environment where growth is operating below trend, but there are signs of hope. Three of my preferred real-time economic data points continue to show signs of positive economic trends:

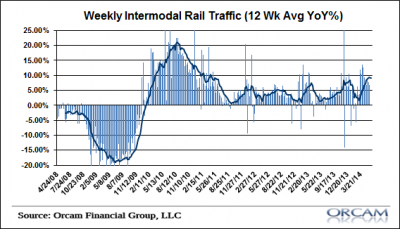

1) Rail traffic continues to perform nicely in Q2 after a slowdown earlier in the year. The latest intermodal reading of 6.8% year over year brings our 12 week moving average to 8.5%. That’s the highest reading in three years.

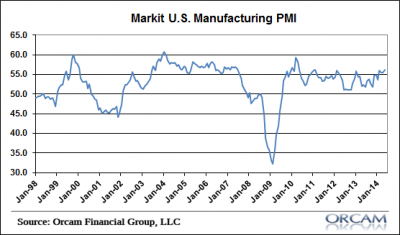

2) Markit’s monthly US PMI registered a flash reading of 56.2 in May, up from 55.4 in April. Output was up to 59.6 and new orders fell slightly to 58.2, all solid readings.

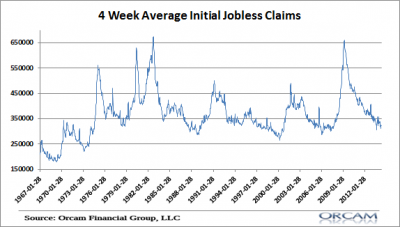

3) The trend in weekly jobless claims, one of the best real-time indicators of the health of the labor market, continues to trend lower. Continuing claims were down 13,000 this week to a new recovery low of 2.653 million. The 4 week average is down to a recovery low of 2.689 million.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.