Thomas Piketty’s new book “Capital” has been called the most important economics text of the year and perhaps of the decade. It’s 685 pages of incredibly thorough inspection regarding wealth and income inequality – what many are calling the biggest debate of our time.

First off, Piketty deserves praise. I can only imagine how much time and effort went into this behemoth of a book. He’s also shed a big bright light on a very important topic and helped to move the discussion in the right direction. While his message clearly has political undertones (one could even argue that it’s Marxist in some ways) I love the way it is delivered as Piketty is extremely open-minded in his views. That is, he clearly has a biased perspective, but he writes the book in such a way that it provides a story backed by evidence which allows the reader to form their own conclusions. Perhaps most importantly, the last line in the book highlights a point that I wholeheartedly agree with:

“all social scientists, all journalists and commentators, all activists in the unions and in politics of whatever stripe, and especially all citizens should take a serious interest in money, its measurement, the facts surrounding it and its history.”

But let’s move on to the real heart of Piketty’s message which is obviously a very important one – wealth and income inequality. If you don’t want to read the book you can basically understand the entire argument if you know the following:

“When the rate of return on capital exceeds the rate of growth of output and income, as it did in the nineteenth century and seems quite likely to do again in the twenty-first, capitalism automatically generates arbitrary and unsustainable inequalities that radically undermine the meritocratic values on which democratic societies are based.”

Piketty refers to this as r > g throughout the text. And he details why he thinks this is harmful:

“The principal destabilizing force has to do with the fact that the private rate of return on capital, r, can be significantly higher for long periods of time than the rate of growth of income and output, g.

The inequality r > g implies that wealth accumulated in the past grows more rapidly than output and wages. This inequality expresses a fundamental logical contradiction. The entrepreneur inevitably tends to become a rentier, more and more dominant over those who own nothing but their labor. Once constituted, capital reproduces itself faster than output increases. The past devours the future.”

That’s the crux of the discussion. Piketty says that this is a development that goes against our democratic and meritocratic values and he backs up this position with an overwhelming amount of data. As I mentioned, it’s well constructed and well researched. But for all the good in the voluminous text I am not certain that Piketty’s argument is all that convincing or that it really contributes as much as the hype might have you think. In particular, I worry that it doesn’t keep things in perspective with regards to the bigger picture. Let me elaborate.

1) The first issue I had with the text was the very concept of “capital”. If you haven’t read James Galbraith’s critique you should. One of the more important points Dr. Galbraith makes is with regards to the way Piketty defines “capital”. He actually steers away from the way Marx defined capital (as power capitalists had over the labor class) and towards something more nebulous – “wealth”. And in doing so I think he confuses the reader on the problem at hand.

This vague definition results in an imprecise discussion about the central concept of the text. After all, what is “inequality” in Piketty’s view? Does it mean some are benefiting at the expense of others? Does it mean that we are all better off, but some less so than others? How does this relate to our “living standards”, something that is never defined in the text? The text implies that the majority of us are going to be worse off in the future, but doesn’t fully connect the dots on that point other than to claim that growth will suffer and fewer people will inherit “wealth”.

In formulating a purely numerical perspective, he asserts that rising wealth greater than rising growth is necessarily bad. Does this mean we are all worse off if the stock market rises 10% per year for 100 years while economic growth averages just 6.5% (as has happened in the USA over the last 100 years)? Is his concept of “inequality” purely a domestic concept or is it a national concept? Surely, while a small slice of Americans are much better off than they were 100 years ago, we are also all better off than we were 100 years ago. After all, the average American family doesn’t worry about how they can feed their children. They worry about whether their children are going to get a cell phone or not. If we glanced at Maslow’s hierarchy of needs it appears rather incontrovertible to me that we are slowly creeping higher up the hierarchy with regards to what our “problems” are (although yes, some people are climbing that hierarchy much faster than others).

But more interestingly, in a global sense, one could argue that the rise of the developed world and its accompanying wealth explosion has been an instrumental driver in helping to bring the emerging world out of substantial poverty. Over 1 billion people have been brought out of extreme poverty in the last 20 years alone. So again, the book struck me as being fairly vague about the very concept of “inequality” because it does not provide a very insightful perspective into the meaning of “wealth” and how it really relates to our living standards.

2) The second major issue I had with the book was that it’s very gloomy about the future. Now, I am a relatively optimistic person so I will try not to view this through rose colored glasses, but man has been making incredible progress for tens of thousands of years. We have grown by leaps and bounds. In the post-industrial revolution era global economic growth has averaged about 2.1%. Since 1913 it has been even higher. Piketty thinks this could drop close to 1% by the end of the century. He echoes the Robert Gordon thesis (the death of innovation, the end of growth).

I will always take the other side of this bet and I think it’s madness for anyone to do the opposite over long periods of time. Anyone betting against humans during the modern economic era over long periods of time has surely lost this bet. This fear based story is great for selling books, but when it comes to making rational forecasts about the future I don’t know if it’s particularly useful. Erik Brynjolfsson does a much better job of debunking the Robert Gordon thesis than I can. But the short story is that we are living in a tremendously exciting time where our living standards are exploding, humans produced more in the last 25 years than in the entire 1,900 previous years and we’re seeing a more balanced global prosperity. Not to mention, this whole concept of measuring our prosperity via economic growth doesn’t even account for all the free stuff (like the innumerable things we can access through the internet) we have in today’s world (because GDP doesn’t calculate this) or the many other ways in which our living standards have improved.

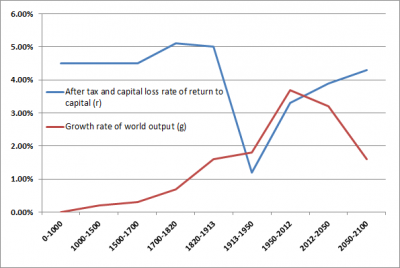

3) There’s a bigger contradiction in this negative outlook. If you’ve read discussions on inequality you’ve likely heard the “secular stagnation” thesis. This is the idea that inequality is leading to lower growth. The following chart is how Piketty shows this playing out:

(Rate of return on capital vs growth rate of world output)

He estimates that the growth rate of world output will decline substantially in the coming century as the return on capital will surge. In essence, both are mean reverting to some degree. But if growth is reverting to the mean then the “secular stagnation” thesis is a myth. In fact, it means that we’ve been in a “secular boom”. But worse, it means that during this era of great “inequality” growth has boomed. This contradicts the “secular stagnation” thesis. In fact, this appears to add some credence to the view that periods with inequality can coincide with periods where “a rising tide lift all boats” to some degree. Additionally, there’s the potential flaw in the bearish view. What if we are actually becoming more productive, more efficient and growing faster than we think (Brynjolfsson estimates that current GDP calculations miss $300B in annual output)? What if Piketty’s bearish reasoning is wrong or even if he’s too bearish?

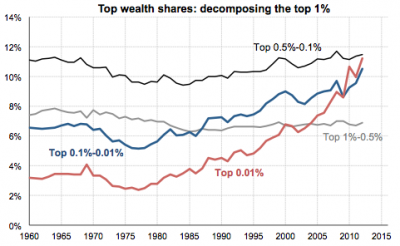

4) My final concern is that he paints with a broad brush. A recent story in The Atlantic puts the US story of “wealth inequality” in the proper perspective:

“It turns out that wealth inequality isn’t about the 1 percent v. the 99 percent at all. It’s about the 0.1 percent v. the 99.9 percent (or, really, the 0.01 percent vs. the 99.99 percent, if you like). Long-story-short is that this group, comprised mostly of bankers and CEOs, is riding the stock market to pick up extraordinary investment income. And it’s this investment income, rather than ordinary earned income, that’s creating this extraordinary wealth gap.

The 0.1 percent isn’t the same group of people every year. There’s considerable churn at the tippy-top. For example, consider the “Fortunate 400,” the IRS’s annual list of the 400 richest tax returns in the country. Between 1992 and 2008, 3,672 different taxpayers appeared on the Fortunate 400 list. Just one percent of the Fortunate 400—four households—appeared on the list all 17 years.”

So this makes the “problem” of inequality pretty cut and dry. It is not a “wealth inequality” issue. It is a problem of income derived largely from what we call “investment income”. There’s your “inequality”. And this makes perfect sense given the changes in the tax structure over the last 40 years. This is pretty damaging to those who have painted this as being a much broader problem, when in fact it’s a very small slice of the population that is most benefiting from this inequality.

And when it comes to solutions Piketty’s thinking is fairly simplistic. He thinks a massive wealth tax is the only answer. But again, I think he’s being too broad here.

The bottom line: inequality is a very real problem. But it’s not a problem to the degree that many are probably making it out to be. There is a great deal of truth to the idea that all of our GLOBAL boats are rising to some degree despite this rising inequality. We are not worse off than we were 100 years ago even if inequality is back to the same levels it was back then. But that doesn’t mean that inequality isn’t an issue at all. As I’ve often stated, the global economy is a not a poker game where one player gets to leave at the end of the night with all the chips. And if the chips increasingly consolidate into the hands of fewer and fewer players the other players must borrow or obtain chips from the big stacks to stay in the game. And yes, the big stacks need the little stacks so the size of the game can continue to grow. So there’s a very real threat to future economic growth here and we are probably already seeing th impact of it to some degree.

The solution, in my opinion, is simple and based on a relatively widespread misunderstanding. We currently tax “investment income” favorably. The rationale for this is that we want to incentivize “investment”. That makes sense except for the fact that very few of the people transacting on secondary markets or obtaining dividend payments are actually promoting investment. In fact, one could argue that dividends disincentivize firms from using profits in a more innovative manner. And transactions on secondary exchanges only finance investment in the case of secondary offerings. Otherwise, buying stocks and bonds is a simple allocation of savings and does not remotely resemble the financing of investment. Why these forms of income are tax advantaged makes very little sense in my view. So a higher tax rate on dividends and secondary market transactions seems to make a lot of sense in my view.

On the whole, it’s an excellent and thought provoking book. Probably 200 pages too long and a bit overhyped, but you can’t blame Piketty for competitive markets that overhype the quality of a product thereby creating excess wealth for the producer in the process. After all, that’s what capitalism is all about, right?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.