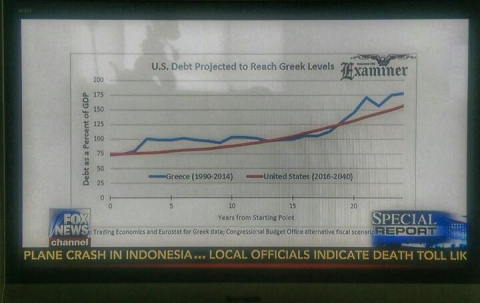

I was flipping through TV this evening when I came across this image projecting that the USA was on course to become Greece:

Aside from the spurious 30 year trend line, this appears like an alluring story. Greece is a country. The USA is a country. If Greece can default because of high debt then couldn’t the USA default because of high debt? Technically, yes, but the crisis would materialize in a very different way thanks to the institutional design of the US monetary system. Let me explain.

The USA has an institutional arrangement in which it is a contingent currency issuer. That is, while the US Treasury is an operational currency user (meaning it must always have funds in its account at the Fed before it can spend those funds) it has the extraordinary power to tax all US output and issue reserve currency backed risk free bonds that the public will always desire to hold so long as inflation is not extraordinarily high. Additionally, in a worst case scenario, the US Treasury can always rely on the Federal Reserve to supply the funds necessary to fund its spending. Imagine having your own bank that would always lend to you. This makes the government quite different from a household.

The key here is that there’s no solvency constraint as in, “running out of money”. Greece doesn’t have this arrangement. Since the ECB is essentially a foreign central bank there is a real solvency constraint and once Greece’s emergency funding line was cut off from the ECB it was forced to default on its IMF loan. So banks and private investors have become hesitant to buy Greek bonds because of this flawed institutional arrangement and the lack of an implicit guarantee. This is not comparable to the USA where the government has tremendous taxable output and a domestic Central Bank which it harnesses.

This doesn’t mean the US government couldn’t one day run out of willing creditors due to economic weakness. Printing money via your own Central Bank doesn’t mean you have “credit”. Any participant in an endogenous money system must be able to find willing holders of its liabilities in what amounts to a form of “funding” (this includes governments). But governments with no foreign denominated debt and a domestic Central Bank do not default on themselves unless their politicians allow such a thing to occur. And when they can’t tax output or sell their bonds to the private sector they are forced to inflate their currency or suffer a foreign exchange crisis. And this is not at all what’s occurring in the USA at present.

I would highly recommend reading the links at this page for more info:

Understanding the Modern Monetary System

Can a Sovereign Currency Issuer Default?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.