One of the points I emphasize in my new paper on portfolio construction is the risk of owning individual securities relative to indexing. A lot of people don’t know this, but since 1980 the S&P 500 has seen 320 departures from the index due to distress. This means that about 10% of the S&P 500 leaves every 5 years because of distress. So, if you’d bought all 500 individual stocks in the S&P 500 in 1980 you would have ridden a substantial number of your holdings to $0 or returns that were substantially worse than the index due to a lack of prudent selling.

One of the beauties of an indexing approach is the rules based systematic approach in which the funds sell their holdings that don’t meet the criteria of the index. We tend to think of index funds as these boring static portfolios, but they’re really quite dynamic and the systematic process is part of what makes them perform so well. An index fund is essentially a great seller and buyer because it adheres to a strict rule and doesn’t fall victim to behavioural biases and whatnot.

This is even more interesting in a broader context because it highlights just how much single entity risk can impact a portfolio. For instance, one of the news stories playing out today is the disaster in Valeant Pharma which is down 50% on the day and 85% since its peak. This is a company held by some of the largest and most prominent hedge funds in the world. So, what does a crash like that do to your portfolio?

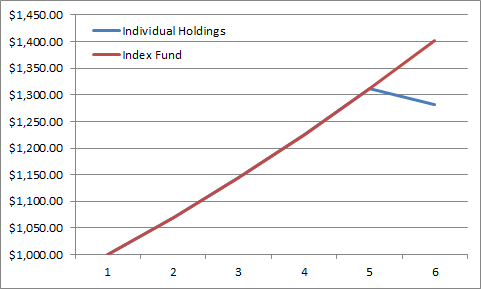

Let’s assume you hold 10 stocks that all appreciate 7% per year for 5 years except one of them crashes 85% in year 5. Thankfully, you were somewhat diversified, but the portfolio still undergoes a dramatic decline relative to an index. While the index grows from $1,000 to $1,400 the individual stock portfolio grows to just $1,282. That’s a 5.1% compound return versus a 7% compound return. Now, imagine that you go through something like this once every 5 years as you pick stocks. Over the course of a 30 year period the difference in your ending balance is $7,500 vs $4,300.

Of course, this is an extreme example, but this highlights the potential risk in the persistent pursuit of market beating returns. Most people end up taking a lot more risk than they should be as they pursue something that is mathematically impossible in the aggregate. Along the way they end up churning up taxes, fees and risks that hurt their portfolios. It’s no wonder that 80%+ of active managers can’t beat a simple indexing approach.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.