I always talk about how important it is to understand accounting when doing economics. While most economists want to build rigorous mathematical models of the world I would much prefer rigorous stock-flow consistent models of the world by understanding the relationship between income statements, cash flow statements and balance sheets. In my opinion, this is a much more useful framework for understanding the cause and effect of certain economic policies and environments.

As an example of this we might look at how Dr. Krugman is analyzing what he calls the “profits-investment disconnect”. Now, he concludes that there’s something nefarious going on here that reflects “monopoly power rather than returns on capital.” But he wouldn’t say this if he looked at the full picture from the perspective of an accounting based model.

First, Dr. K is right that there appears to be a “profits-investment disconnect”. But this isn’t due to greedy monopolists hoarding more than they should. It’s mostly just that corporations are giving back much more of their profits in the form of dividends and households are saving less.

Here’s the basic accounting behind corporate profits:

Profits = Investment – Household Savings – Government Savings – Foreign Savings + Dividends

Now, if you read my recent post on dividends as the “secret sauce in corporate profits” you know that dividends contribute to corporate profits. It’s a bit counter-intuitive, but as I’ve explained:

“Corporations don’t count dividends as a business expense because they’re distributed profits. And if households spend all of this dividend income (ie, don’t increase their saving) then this contributes to corporate profits. So, if the household saving rate remains the same then that means that increased dividends are actually ADDING to corporate profits over time (as has been the case in recent decades).”

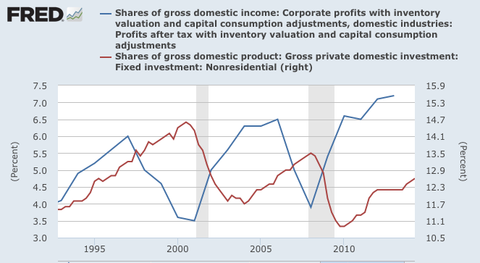

So, if you look at business spending as purely “investment” then you’ll be inclined to come up with the same conclusion that Dr. Krugman comes up with which looks like this one where businesses aren’t spending:

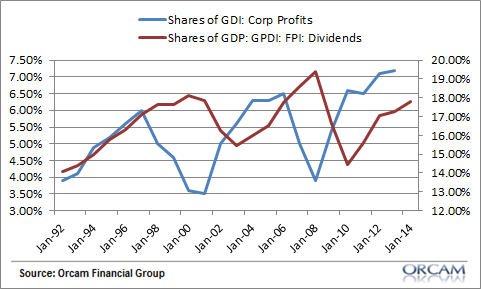

If you understand the accounting behind corporate profits then this doesn’t tell the full picture. You have to include dividends in the picture considering that dividends have become 5% of the share of GDP as of Q1 2014. When you add dividends back into the mix you get this far less greedy looking picture:

Now, that’s a pretty different image than the first one above. There’s still some “disconnect”, but it’s not nearly as horrible looking as it is in the original Krugman chart. But if one were so inclined, they might just use the first chart to claim that corporations are big bad evil greedy monsters who aren’t spending enough. But if you add the dividends back in then you see that business spending that includes dividends is actually at pretty healthy levels. There’s really nothing all that unusual going on there.

Of course, the question isn’t about whether corporations are evil monopolists. Any good capitalist entity is an inherent monopolist that tries to maximize its share of profits – is that somehow news to some people? But that’s not really what matters here. The problem isn’t that these corporations aren’t spending enough – they clearly are spending when you look at the full picture. The problem is that they’re not INVESTING enough. So Krugman is right, but he’s right for the wrong reasons because this has less to do with monopolies and more to do with a crummy economic environment where corporations are choosing not to reinvest because they think it’s better to return capital to shareholders in other manners.

The mess of it all is that if economists and politicians were to understand some of this accounting a bit better they’d know that the easiest lever to pull for an improvement in both aggregate demand and profits would be a larger deficit (tax cuts or government investment would be my preferred policies) since this would add to private sector financial assets (deficit spending adds a private sector asset without a private sector liability) which would improve private sector balance sheets resulting in income and more demand which would add to corporate revenues which would incentivize businesses to invest more. But since our politicians and our leading economists don’t understand these points then they politicize everything, demonize corporations unnecessarily and the other side fights back with their own non-sensical rhetoric because they’re defending a certain ideological narrative. And we end up right where we started because we’re defending against constant attacks.

And this, to a large degree, is why we’re in the mess we’re in. Economists and politicians would rather politicize all of this instead of looking at the world from an operational level where we might actually resolve problems in a reasonable and bipartisan manner….Instead, we just sling mud at each other and point fingers. Pretty cool, huh?

Related:

- Pragmatic Capitalism: What Every Investor Needs to Know About Money and Finance

- Understanding the Modern Monetary System

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.