Another good excerpt here from John Mauldin over the weekend. This time he’s passing on some thoughts from Ray Dalio and Bridgewater discussing the Fed’s Dilemma with QE, the impact on asset prices and the potential for bubbles:

“In the old days central banks moved interest rates to run monetary policy. By watching the flows, we could see how lowering interest rates stimulated the economy by 1) reducing debt service burdens which improved cash flows and spending, 2) making it easier to buy items marked on credit because the monthly payments declined, which raised demand (initially for interest rate sensitive items like durable goods and housing) and 3) producing a positive wealth effect because the lower interest rate would raise the present value of most investment assets (and we saw how raising interest rates has had the opposite effect).

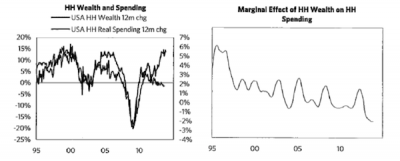

All that changed when interest rates hit 0%; “printing money” (QE) replaced interest-rate changes. Because central banks can only buy financial assets, quantitative easing drove up the prices of financial assets and did not have as broad of an effect on the economy. The Fed’s ability to stimulate the economy became increasingly reliant on those who experience the increased wealth trickling it down to spending and incomes, which happened in decreasing degrees (for logical reasons, given who owned the assets and their decreasing marginal propensities to consume). As shown in the charts below, the marginal effects of wealth increases on economic activity have been declining significantly. The Fed’s dilemma is that its policy is creating a financial market bubble that is large relative to the pickup in the economy that it is producing. If it were targeting asset prices, it would tighten monetary policy to curtail the emerging bubble, whereas if it were targeting economic conditions, it would have a slight easing bias. In other words, 1) the Fed is faced with a difficult choice, and 2) it is losing its effectiveness.”

(In the following charts HH stands for “Household.”)

We expect this limit to worsen. As the Fed pushes asset prices higher and prospective asset returns lower, and cash yields can’t decline, the spread between the prospective returns of risky assets and those of safe assets (i.e. risk premia) will shrink at the same time as the riskiness of risky assets will not decline, changing the reward-to-risk ratio in a way that will make it more difficult to push asset prices higher and create a wealth effect. Said differently, at higher prices and lower expected returns the compensation for taking risk will be too small to get investors to bid prices up and drive prospective returns down further. If that were to happen, it would become difficult for the Fed to produce much more of a wealth effect. If that were the case at the same time as the trickling down of the wealth effect to spending continues to diminish, which seems likely, the Fed’s power to affect the economy would be greatly reduced.”

Personally, I think we have to be careful declaring that QE has done nothing for the real economy. And the implication that QE just drives up asset prices and causes bubbles implies precisely that. Rather, I think it’s important to note that QE’s of differing flavors have had differing impacts. QE1, for instance, has a substantial impact on the markets and the economy as the Fed essentially played market maker in a totally dysfunctional market. That was a huge benefit to balance sheets and asset prices.

It’s probably safe to say that future QE programs have all had diminishing returns, however. And in the current environment we have to understand how all of this has related to the end of the Balance Sheet Recession and the change in the government’s deficit spending position. As the private sector has recovered the government has played a reduced role in the economy, however, the backstop from deficit spending has now been substantially reduced which means we’re increasingly operating on an economy that is private sector driven. That’s a good thing, but it also creates greater potential for instability as the Bernanke Put could be confused as something that will put a floor under the economy when in reality, the Fed’s QE programs are likely not having a huge impact on the economy while the deficit declines.

Personally, I think (and have thought) the economy was stronger than many people presume and I think QE has had far less to do with this than most people think. So the thing to keep a close eye on here is not the Fed so much, but the new driver of the private sector recovery – corporate America.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.