The San Francisco Fed has a nice piece of research here detailing the coming fiscal headwind. One of the main reasons I’ve been more inclined to say recession will occur in 2013 is because the real government fiscal retrenchment likely won’t hit until then. As the SF Fed notes, the impact could be substantial:

“Federal fiscal policy will increasingly weigh on economic growth in coming years, according to CBO projections. The CBO projects two possible paths for federal outlays and revenue, both of which would damp GDP growth. The more severe is its baseline scenario which assumes that federal fiscal policy in coming years will follow current law. This includes automatic spending cuts enacted in August 2011, and the expiration of the 2001 and 2003 tax cuts and several other tax provisions. These changes are generally scheduled to take effect at the end of 2012. They constitute what has been called a “fiscal cliff,” meaning that they represent a large and sudden contraction of the government budget.

The CBO’s second scenario is milder, though still not benign for near-term economic growth. This alternative assumes current tax policies continue and that Congress will undo the sharp automatic spending cuts set to take place at the end of the year, but that discretionary spending caps passed in 2011 will stay in effect.

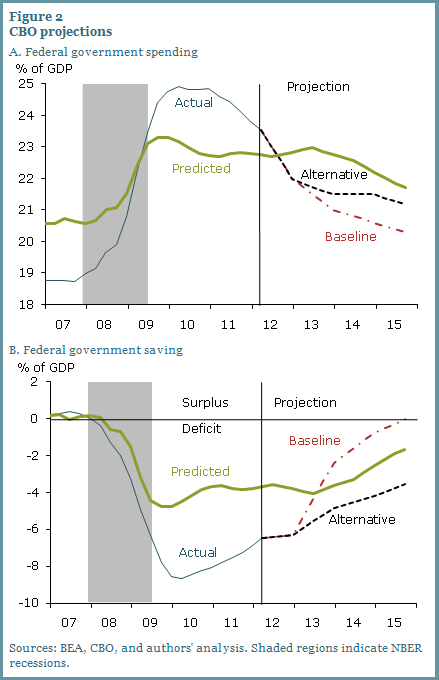

Figure 2, panel A compares both CBO projections of federal spending with the level predicted by our statistical model. Under either CBO scenario, spending over the remainder of 2012 is projected to fall faster than would be expected based on the pace of economic recovery. Beyond 2012, the CBO projects that under either scenario government spending will contract at least for the next decade roughly in line with our statistical model. The retrenchment in 2013 would be much sharper under the current-law baseline projection than under the CBO’s second scenario, in which automatic spending cuts are avoided.

Figure 2, panel B shows that, as spending falls and tax revenue rises, the federal deficit is expected to shrink over the next one to two years under either scenario, faster than would be predicted based on its historical pattern through the business cycle. In a continuation of the subpar pace of recovery from the Great Recession, the gap between actual GDP and potential output is expected to close very slowly over the next couple of years. The typical countercyclical pattern of federal fiscal policy would predict that the deficit would remain large longer than the CBO projects. Just how fast fiscal tightening occurs and how large the headwind to economic growth will be depend on future policy decisions. The deficit is projected to shrink much more quickly under the CBO’s baseline scenario. However, even under the milder alternative scenario, the shrinking deficit implies a headwind for GDP growth in the near term.”

And their conclusion? The fiscal tailwind has now turned into a fiscal headwind:

“In aggregate, state, local, and federal fiscal policy was unusually expansionary during the Great Recession, but has since reversed course. Overall government spending and the combined state, local, and federal deficit have been declining over the past year more rapidly than would be expected given the slow pace of recovery and the typical countercyclical pattern of fiscal policy. Moreover, CBO projections suggest that fiscal policy, at least at the federal level, will become increasingly contractionary over the next couple of years compared with normal cyclical patterns. This suggests that the tailwinds fiscal policy provided to economic growth during the Great Recession and the first few years of recovery have shifted direction. Going forward, the forecast calls for fiscal headwinds.”

Read more here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.