Paul Krugman has a post out today with a simple guideline for understanding the current environment where interest rates are rising, stocks are climbing and the dollar is climbing. He says:

“I’ve been getting some questions about the recent rise in long-term interest rates. Those rates are still at levels that would have seemed absurdly low not long ago — but they are up significantly from a few months ago. What should we make of this move?

…

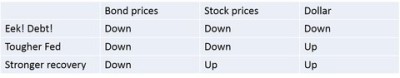

So when long-term interest rates rise, there are three main stories you hear. One is that the bond vigilantes have arrived, and are selling US debt because they now believe in the horror stories. Another is that the Fed has changed, that it may be ready to snatch away the punch bowl sooner than previously believed. And the third is that the economy is looking stronger than expected, which means that the Fed, although just as soft-hearted as before, will nonetheless start raising rates sooner than previously believed.

All three of these stories would imply falling bond prices, that is, rising interest rates. But they have different implications for other markets, in particular for stocks and the dollar. Debt fears — basically, a run on America — should send stocks and the dollar down along with bonds. A perceived tougher Fed should send stocks down but the dollar up. And a better recovery should send both stocks up (because of higher expected profits) and drive the dollar higher.”

He then shows this table which ties the story together neatly:

There’s just one huge problem with that. Stocks don’t tend to fall when the Fed gets tougher and the dollar also doesn’t tend to rise. Since 1954 there have been 11 major Fed tightening cycles (trough to peak Fed Funds Rate). During those cycles the S&P 500 rallied 11% on average while the broad dollar basket lost 0.5%. So the story isn’t as cut and dry as Dr. Krugman makes it seem. And sometimes that’s the story from the markets – there just isn’t a rational explanation for particular moves. In my opinion, the recent moves in the bond market appear to be some mixture of economic optimism and utter confusion over QE and the future of Fed policy. But there’s no hard and fast rule that can be applied to particular asset price moves and attempts to apply reasoning to often unpredictable and irrational market moves is futile.

PS – Dr. Krugman is dead right about the bond vigilantes. They’re not coming to attack us. If anything, they’re going to scavenge off the communications from the Fed.

PPS – I am not saying that stocks CAN’T fall if the Fed tightens. I am simply saying that the idea that “Fed tightening = lower stocks” is not backed by strong historical evidence.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.