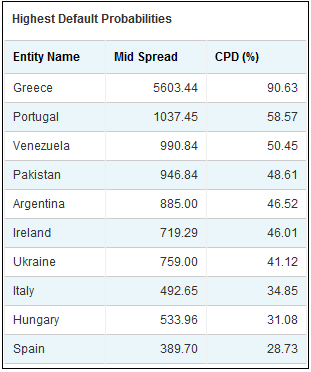

If you didn’t know any better you might have assumed that the outlook for sovereign defaults in Europe had deteriorated quite substantially as Italian yields continue to push higher and the never ending crisis just continues to endure. But since early September the cumulative probability of default according to CMA (see here) has actually declined in periphery Europe aside from Greece. Based on credit default swaps the probability of default remains a near certainty in Greece while Portugal and Ireland are still very much at risk. Italy’s situation, on the other hand, has improved just marginally. I think the markets have come to grips with the idea that Italy simply will not be allowed to fail. The situation for Greece is obviously more dire.

The interesting conundrum based on this is where Europe goes from here. If Italian yields are rising and the likelihood of default remains relatively low or improbable, then it’s safe to conclude that the markets fully expect Italy to survive this crisis as a Euro member. But if the budget situation in Italy is going to continue to deteriorate (a high probability event at this point) and yields continue to move higher then the conclusion is simple – Europe has to do more to help and the bond vigilantes in Italy are happy to force the issue. I’ve been pretty clear about the direction I think they need to move in, but it’s becoming increasingly clear that Europe is not ready for E-bonds or a fiscal union. I am afraid they don’t have much of a choice if the market action is right (which, is of course, no certainty). The currency imbalance via trade will not resolve itself as the union is currently constructed. Therefore, I assume Europe will be forced into even further action in 2012.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.