Understanding the importance of the Federal budget Deficit in recent years is really very simple. In a healthy economic environment private investment is one of the primary drivers of economic growth and improvements in living standards. But what happened in the Great Recession was highly unusual. Private investment collapsed in an almost unprecedented fashion. When GDP was contracting in the 2008/2009 period it was driven almost entirely by this collapse in gross private domestic investment. So, getting the economy back on track was largely about replacing or healing this decline in the private sector driver of growth.

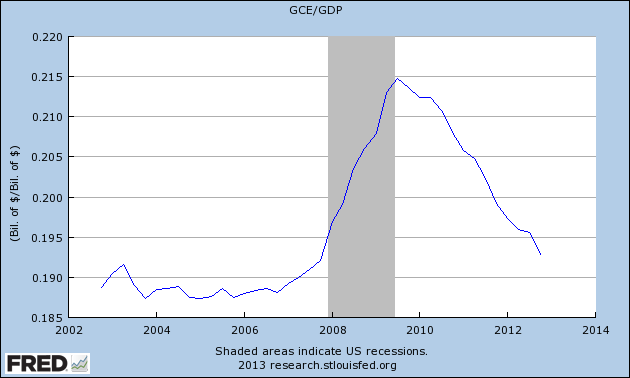

How was that done? Simple, the government ran huge budget deficits. So, spending as a percentage of GDP surged. Government consumption expenditures surged in the same period as private investment collapsed. As you can see, government expenditures have remained high though they’re trending down. This has kept the economy moderately strong as the private sector healed. But, as we can see above, private investment is still far below its historical average and below levels seen during any past recession.

At the end of the day, the economy is just a series of flows. Consumers spend, businesses invest, government spends, all of this generates income, revenues, cash flows, and as long as the flow is steady and strong the economy expands and life appears all fine and dandy. But when private investment collapsed the flow was weakened substantially. Had we not kicked in the government spending to turn the flow back on we likely would have experienced an economic environment that would have resembled something closer to Spain or Greece as opposed to this muddle through we’re currently experiencing.

This is, in essence, the core to understanding the balance sheet recession theory (in addition to understanding WHY private investment collapsed the way it did – due to the debt bubble). It’s not terribly complex. So, you can understand why I am at least moderately concerned by the CBO’s latest projections:

“The federal budget deficit, which shrank as a percentage of GDP for the third year in a row in 2012, will fall again in 2013, if current laws remain the same. At an estimated $845 billion, the 2013 imbalance would be the first deficit in five years below $1 trillion; and at 5.3 percent of GDP, it would be only about half as large, relative to the size of the economy, as the deficit was in 2009. Nevertheless, if the laws that govern taxes and spending do not change, federal debt held by the public will reach 76 percent of GDP by the end of this fiscal year, the largest percentage since 1950.

With revenues expected to rise more rapidly than spending in the next few years under current law, the deficit is projected to dip as low as 2.4 percent of GDP by 2015. In later years, however, projected deficits rise steadily, reaching almost 4 percent of GDP in 2023. For the 2014–2023 period, deficits in CBO’s baseline projections total $7.0 trillion. With such deficits, federal debt would remain above 73 percent of GDP—far higher than the 39 percent average seen over the past four decades. (As recently as the end of 2007, federal debt equaled just 36 percent of GDP.) Moreover, debt would be increasing relative to the size of the economy in the second half of the decade.”

In order to get back to the normalcy of the pre-GFC days we need to see that first chart above get back to its historical average of about 0.16. That’s a lot to ask given the time its taken just to improve back to current levels.

I’ve stated in the past that I though the balance sheet recession would end by 2013/2014. And while debt trends have definitely improved we’re still seeing a very tepid private investment environment. We could definitely see further improvement there, but I still think the downside in the deficit is the largest risk to economy at present. I’ve probably been a bit overly optimistic about the improvement in the balance sheet recession as I see private investment remaining weak well into 2014. And that means the private sector will need continued help as it heals.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.