Societe Generale has joined the chorus of forecasters calling for a slow-down and not a collapse in the US economy. A nice brief summary from their latest strategy notes:

“FED FOCUS: We see QE3 as highly unlikely

Soft patch of data has brought back speculation about QE3. Highly unlikely: in contrast to last year’s slowdown, current softness has not pushed down long-term inflation expectations.

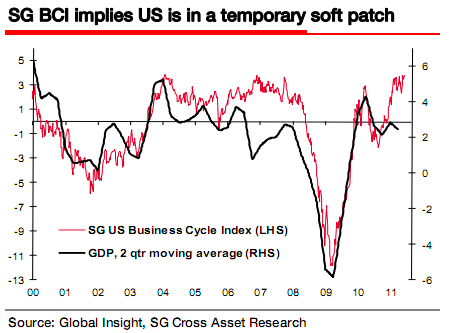

ECONOMICS: SG Business Cycle Index remains strong

Main drivers lately: swaps spreads, equity returns, commodity prices. But other variables (consumer confidence, commercial & industrial loans) picking up the baton. Those positive signals should materialize in robust GDP growth in H2.”

“FISCAL FOCUS: Rating agencies ready to give a bad review

Very little progress has been made on debt ceiling and long-term budget solution.

Moody’s says it may likely lower US credit rating if debt ceiling not raised and US enters into technical default”

Source: SG Research

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.