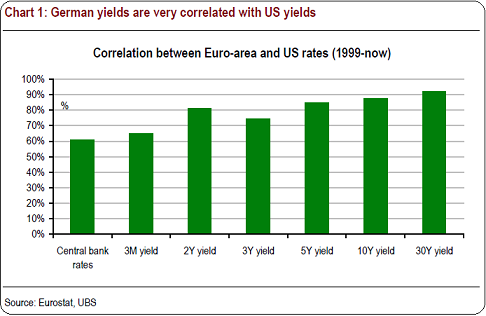

If you’re a US Treasury investor looking to diversify into international bonds you might want to look outside of the German Bund market. A nice piece of research from UBS shows that there is a very high correlation between US Treasuries and Bunds (see chart below). Interestingly, they argue that a new bear market in Bunds is beginning now which obviously implies that a new bear market in Treasuries is beginning. They offer three reasons to support their argument:

“In their weekly last weekend, our colleagues from the Asset Allocation team argued that a secular bear market in bonds had begun. They wrote: “The jump in US Treasury yields this week marks a secular turning point for bond markets. We believe a long-term bear market has commenced. The source of the sell-off is clear—an improved and more durable global economic recovery, particularly in the US.” For more details see Weekly Weight Watcher: The bear market in bonds is here (16 March 2012). In this piece we argue that Bunds could also follow suit, albeit at a slower pace and probably with a lag.

There are three main reasons for a bear market: (1) a sustainable recovery in the US has taken root, (2) Chinese and overall emerging economy growth will be just fine, and (3) the Eurozone recession poses fewer risks to the rest of the world economy. If the capacity of the European crisis to cause problems has indeed waned, that would allow Treasury yields to rise. But would that be enough to prompt a similar move in Europe?”

I’ve long made my position on bonds clear and my calls over the years have been pretty much spot-on. Don’t fight the Fed. And the Fed’s message is clear – they’re on hold for the foreseeable future. Now, I’ve been bearish on long bonds since the beginning of the year, but that doesn’t mean a new bear market has started. It just means the market got a little bit excessively bullish about bonds and excessively bearish about just about everything else in the global economy. That environment is in the process of correcting and will result in an attractive entry point sooner rather than later. But be wary of those trying to call a bottom in a 30 year bull market. Especially when they’re fighting the Fed…..

Source: UBS

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.