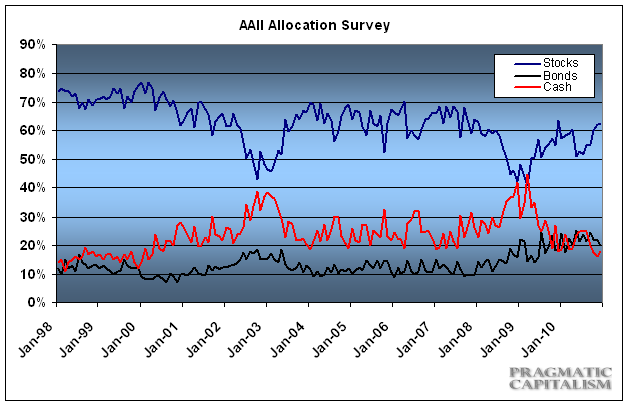

Small investors are feeling more confident about the stock market and they’re putting their money to put. According to the AAII small investors now have the highest equity allocations since December 2009 (via AAII):

“Individual investors increased their allocations to equities for the fifth time in six months. According to the January AAII Asset Allocation Survey, stocks and stock funds accounted for 63.5% of individual investor portfolios. This is the largest allocation to equities since December 2009. It is also only the second time since 2007 that AAII members have held more than 63% of their portfolios in stocks and stock funds. The historical average is 60%.

Fixed-income allocations fell for the fourth consecutive month. Bonds and bond funds accounted for 19% of individual investor portfolios last month, an 11-month low. The historical average is 15%.

Cash allocations declined slightly to 17.5%. Cash allocations have been close to this level during three out of the past four months. The historical average is 25%.

The rising allocation to stocks and stock funds confirms what we have seen in our sentiment survey. Optimism about the six-month outlook for stocks has been it above its historical average for 21 consecutive weeks. Fears that bond yields will be higher in the future are also playing a role. Several AAII members have said they are favoring dividend-paying stocks over bonds as a source of portfolio income.”

Source: AAII

Source: AAII

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.