One of the best parts about Twitter is that you can follow super smart people and just read their interactions. For instance, yesterday I was creeping on Jeremiah Lowin, Jake from Econompic and Corey Hoffstein. These are three super smart finance guys who were going back and forth about the rebalancing bonus which was made famous by William Bernstein.

I will let you assess their comments as you wish, but I have a A LOT to say about rebalancing because it’s so central to everything I profess so here’s my general thoughts on the idea of a “rebalancing bonus”.

The basic idea of a rebalancing bonus is that you will rebalance a portfolio away from higher risk assets when they’ve gone up in value and rebalance towards lower performing assets thereby generating a better return than your original expected return. It is, in essence, a systematic way of selling high and buying low. For instance, when your 50/50 stock/bond portfolio grows into 60/40 you want to rebalance back to 50/50 and sell the stocks to rebalance back towards the lower risk and lower performing asset because now you’re overexposed to the higher risk asset.¹ That’s simple enough. But why does this generate what Bernstein calls a rebalancing bonus?

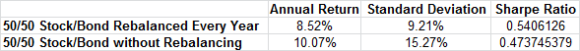

There’s a lot of debate about why this works or whether it works at all. And in fact, the results are quite different in nominal and risk adjusted terms. If we look at the data since 1940 a portfolio of 50/50 stocks/bonds will do slightly better on a risk adjusted basis and does 1.5% worse per year when rebalanced.

There’s a bunch of interesting elements within these results:

- Why is there a risk adjusted rebalancing bonus? The nominal results are obvious – stocks tend to beat bonds so a portfolio that becomes more and more overweight stocks will tend to do better on average. The superior risk adjusted returns are a point of contention in financial circles though. I think it’s pretty simple – the Global Financial Asset Portfolio is a lot more stable than most people think across time. It is currently 46% stocks and 54% bonds, but has been pretty close to a 50/50 portfolio since 1960 when reliable data is first available. So it makes sense then, if this is “the market” portfolio that rebalancing ever closer to this portfolio will generate a more efficient type of return. In other words, rebalancing away from stocks when they grow disproportionately in your portfolio is another way of rebalancing back towards the market portfolio.

Now, many people are quick to argue that “you can’t eat risk adjusted returns”. This is bull shit in my experience. You don’t rebalance to beat the market. You rebalance to ensure you don’t get scared out of the market. This is the crucial element here. Again, it’s all about behavioral alpha.

As I recently wrote, the suboptimal strategy that you stick with is better than the optimal strategy that you bail on. That’s because you’ll achieve a higher total return from the suboptimal strategy than you will trying to chase what looks like the optimal strategy (all the while generating lower returns due to higher taxes, higher fees and performance chasing). So you get more return from a suboptimal strategy that you stick with rather than the strategy you’re constantly bailing out of. And if the suboptimal strategy is the strategy that generates higher risk adjusted returns then you’re absolutely eating more of the nominal returns than you will in the strategy that looks optimal on paper, but leads to worse behavior and lower nominal returns.

The above data is a perfect example of this. If you showed these results to 100 investors my guess is that most of them would want the higher return portfolio. But the higher return portfolio comes with a lot more risk. In other words, the portfolio that you don’t rebalance is the portfolio that will expose you to more and more equity market risk over time and that means you’re exposing yourself to more and more behavioral risk. So those same 100 investors are more likely to bail on the higher risk portfolio when it performs poorly. And on average, the lower return portfolio will generate an average higher investor return because it’s the strategy that you actually stick with over time.

In sum:

- You might get a rebalancing bonus in risk adjusted terms by rebalancing away from high performing assets. But that will come at the expense of lower nominal returns.

- The cause of this bonus is due to a rebalancing process that generates a portfolio that is more consistent with the Global Financial Asset Portfolio.

- Rebalancing is the process of instilling discipline in your portfolio by maintaining a consistently tolerable risk profile over time.

- Although the risk adjusted rebalancing bonus is not guaranteed the odds of achieving behavioral alpha (better performance through better behavior) is increased because rebalancing results in a portfolio that you’re more likely to stick with over time.

¹ – I’m an advocate of doing something a bit different than this. Countercyclical Indexing is a low cost and tax efficient form of indexing that rebalances periodically in order to account for the amount of risk that the markets expose to your portfolio. So, for instance, when 50/50 grows into 60/40 it might not be wise to rebalance back to 50/50 because your new 50% equity allocation might be riskier than your original 50% equity holding. So, late in a market cycle it typically makes sense to rebalance FURTHER away from stocks to something like 40% stocks. In doing so you not only benefit from the behavioral alpha of rebalancing consistently, but you also reduce the potential exposure to the equity markets when they are likely to be most volatile later in a market cycle.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.