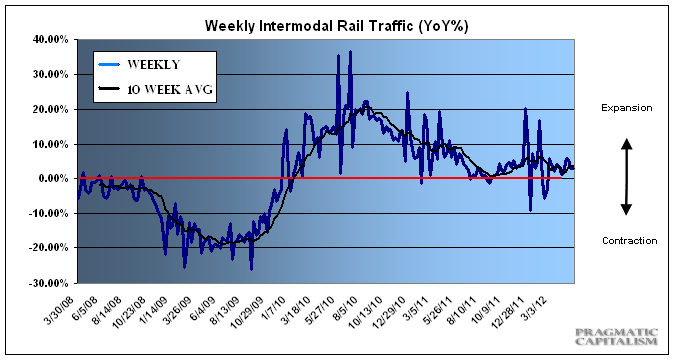

Rail traffic was mixed again this week, but the trend in intermodal remains modestly positive. The AAR reported a decline of 3.1% in carloads and an increase of 4.1% in intermodal traffic. The 10 week moving average in intermodal ticked up to 3.5%. I track intermodal because it has tended to involve less volatility in specific commodity names and tracks the economy a bitter more closely. While intermodal growth is nowhere near the rate of change we saw in 2010, it’s clearly still growing. This served as an early warning indicator into the 2008 downturn and has yet to show signs of contraction. Here’s more from the AAR:

“The Association of American Railroads (AAR) today reported U.S. rail carloads originated in May 2012 totaled 1,392,352, down 40,405 carloads or 2.8 percent, compared with May 2011. Intermodal volume in May 2012 was 1,178,312 trailers and containers, up 39,696 units or up 3.5 percent, compared with May 2011. The May 2012 weekly intermodal average of 235,662 trailers and containers is the highest May average in history. Detailed monthly data charts and tables will be available in the AAR’s Rail Time Indicators released online tomorrow.

Thirteen of the 20 commodity categories tracked by the AAR saw carload gains in May 2012 compared with May 2011, including: motor vehicles, up 17,066 cars or 27.7 percent; petroleum and petroleum products, up 16,460 carloads, or 49.2 percent; crushed stone, sand and gravel, up 7,535 carloads, or 8.2 percent; lumber and wood products, up 2,357 carloads, or 16.9 percent, and primary metal products, up 2,260 carloads, or 4.3 percent.

Commodities with carload declines in May were led by coal, down 74,469 carloads, or 12.1 percent compared with May 2011. Other commodities with declines included grain, down 13,322 carloads, or 11.8 percent; chemicals, down 3,563 carloads, or 2.4 percent, and nonmetallic minerals, down 2,181 carloads, or 8.7 percent. Carloads excluding coal and grain were up 47,386 carloads, or 6.7 percent.

Class I railroad employment in April was up by 1,353 employees to 161,876, its highest level since November 2008. Total Class I employment in April 2012 was up 5,099 employees, or 3.3 percent, compared with April 2011.

As of June 1, 2012, 312,938 freight cars were in storage, an increase of 4,981 from May 1, 2012, and equal to 20.4 percent of the North American fleet. Total cars in storage have increased for eight straight months.

AAR today also reported mixed weekly rail traffic for the week ending June 2, 2012, with U.S. railroads originating 265,207 carloads, down 3.1 percent compared with the same week last year. Intermodal volume for the week totaled 213,911 trailers and containers, up 4.1 percent compared with the same week last year.

Eleven of the 20 carload commodity groups posted increases compared with the same week in 2011, with petroleum products, up 48.8 percent; motor vehicles and equipment, up 18.7 percent, and iron and steel scrap, up 16.2 percent. The groups showing a decrease in weekly traffic included coal, down 11.2 percent, and farm products excluding grain, down 9.5 percent.

Weekly carload volume on Eastern railroads was down 4.8 percent compared with the same week last year. In the West, weekly carload volume was down 1.9 percent compared with the same week in 2011.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.