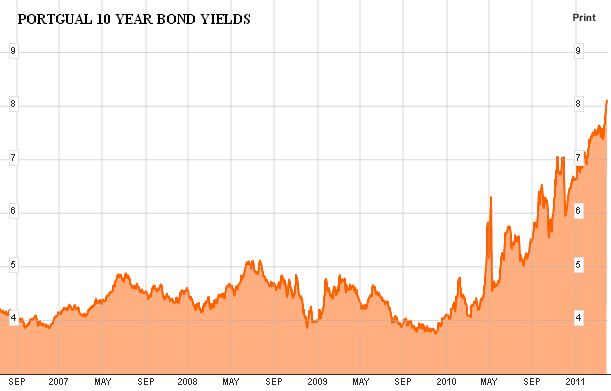

Portugal is toast. At least that’s what the bond markets are telling us. As previously mentioned, 7% yields were unsustainable so that pretty much means 8%+ yields are catastrophic. Portugal is going to need assistance despite their claims otherwise. The wrath of the single currency system continues to spread viciously throughout the region.

I’ve previously discussed potential outcomes, but the situation is so complex that I don’t know if anyone really understands how this will all unfold. In a recent paper Pedro Leao of ISEG, Technical University of Lisbon, Portugal says there is increasing odds of a defection:

“The dramatic sovereign debt crisis currently afflicting the Mediterranean EZ countries and Ireland has brought to the fore the rising heterogeneity observed within the EZ. As some studies emphasize, there has been a persistent loss in international competitiveness for the Mediterranean EZ countries (Greece, Italy, Portugal, and Spain) vis-à-vis Germany since the launch of the euro in 1999. In turn, this situation has translated into large current account deficits being exhibited by these countries along with high levels of indebtedness by both the private and public sector. Furthermore, the integration of these countries into the EZ has so far consisted essentially of an intense process of financial integration whereby they have financed their current account deficits by increasing their indebtedness vis-à-vis core EZ countries like Germany. Having embarked upon ambitious fiscal consolidation and unpopular structural reforms these countries currently face a painful decade of stagnation and high unemployment. The purpose of this study was to evaluate the growth prospects within the EMU for Portugal. In the process, we made two proposals for institutional reform of the EMU with a view to restoring economic growth across the EZ. Our main conclusion is that, in the absence of deep institutional reform in the EMU, growth prospects for Portugal are dim and so leaving the EZ currently represents a serious political option for Portugal.”

Defection is clearly in the short-term best interests of the periphery nations, however, the core nations will fight tooth and nail to keep the currency union together. Until there is some form of true unity here we are simply going to see continued depression and unrest on the periphery. If the citizens of these nations ever wake up to the fact that they are bailing out German banks the situation could quickly become combustible. Personally, I think we’re moving towards some form of a unified Europe, but I can’t predict whether that will involve some of these periphery countries or not. The best outlook from an investment perspective is to simply steer clear of all things Europe….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.