This is probably the most important thing you can learn about allocating your savings:

No one really knows what individual firms are worth at any given time.

When you recognize this fact you immediately step back from the constant media frenzy surrounding individual stocks. You recognize that it makes no sense to even try to have an opinion on individual stocks because they are so complex and unpredictable that trying to pick the winners and losers will inevitably result in excessive risk, taxes and fees along the way. So, you index.

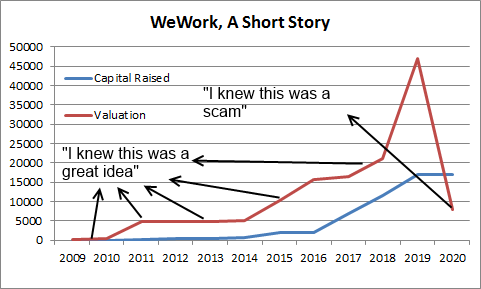

This is even more true in the private equity markets where valuations are more opaque. For instance, the Internet is outraged today because SoftBank bought out WeWork owner Adam Neumann. Now, I can’t speak to the nature of the self dealing and all, but the valuation story on WeWork has been pretty clear for most of the last 10 years – investors hated it, then loved it, and then about 12 months ago started to hate it again. This. Isn’t. A. New. Story.¹

I have zero opinion on this company and its individual stock, but there’s a good lesson to be learned here. Almost no one was saying that this was a bad investment back in 2014 when they last raised capital at a $8B valuation. But today when they raise capital at a $8B valuation people are outraged and saying that they knew this was a scam all along. Sure, maybe some of them did. But the market certainly didn’t think so all along.

So what we end up with here is a lot of hindsight bias that is so typical of stock picking. During the boom people are pouring in money and feeling good about their decision because the risks seem to have paid off. And then when it comes crashing down many of those same people will claim that they saw it coming all along.

We will even tell ourselves this in retrospect. And we do this all through the boom and bust cycle:

2009 – “Oh, this looks like a terrible idea, WHO WOULD INVEST IN A REAL ESTATE COMPANY DURING A REAL ESTATE CRISIS?”

2013 – “The real estate market looks like it’s bottoming. Maybe I should dip my toe in? Nahhh. I want to see if this is a real recovery.”

2015 – “$8B. Gosh, I knew this was going to be a good idea when the real estate market started to to turn in 2013. I should have gone all in.”

2018 – “It’s fallen from $45B to $8B! This was so obviously a scam. I can’t believe anyone ever invested in this.”

Some version of this story exists in every single individual stock story. We will tell ourselves all sorts of things to justify our good and bad decisions. But the reality of the matter is that we don’t really know much about individual firms. We don’t know how they’ll perform. We don’t know how other people will assess that performance. And telling ourselves narratives, while gratifying, isn’t a good strategy that justifies your future attempts to value something you don’t know the value of.

NB – This is not to say that there’s no practical reason for stock picking. There are people who can afford to take the risk and need to take the risk. There’s even a potential place for it in most individual investors’ portfolios. But we shouldn’t fool ourselves with these narratives when it comes to the outsized risks we’re taking when we concentrate our equity risk.

¹ – Honestly, I don’t understand the allure of these co-workspace concepts. And it sounds like this company was involved in some pretty borderline fraudulent dealings. But maybe my bearishness is the exact reason why this company is going to succeed? But who am I kidding? I have no idea!!!

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.