More signs of a broadening recovery from the NFIB’s report on small business in February. Optimism continued to rise as small businesses experienced improvement almost across the board in the early portion of 2011. Although sales remain “weak” there were broad improvements in hiring and general expectations going forward. Despite this improvement the NFIB points out that the current readings are not consistent with a strong recovery:

The Index of Small Business Optimism gained 0.4 points in February, rising to 94.5, not the hoped-for surge that would signal a shift into “second gear” for economic growth. Gross Domestic Product (GDP) growth in the fourth quarter was revised lower due to a large fall off in inventory building and weaker consumer spending than initially estimated. “Weak sales” still get the most votes by owners as their top business problem. Seven Index components advanced or were unchanged and three fell, but all of the changes, positive or negative, were small.Most notably, hiring and future plans to hire were solid and hopefully presage a string of steady job creation months this year. While historically weak, these relative gains signal good news for a sector still deeply encumbered by weak sales. Still, only a net 9% of small business owners surveyed expect that business conditions will improve over the next six months.

“This is not a reading that characterizes a strongly rebounding economy,” said NFIB chief economist Bill Dunkelberg. “But it is the third best reading since the fourth quarter of 2009 when the economy was expanding rapidly. So, it gives us cause for some real optimism. Apparently the future is looking brighter for a few more small-business owners, although much will depend on what Congress does this year.”

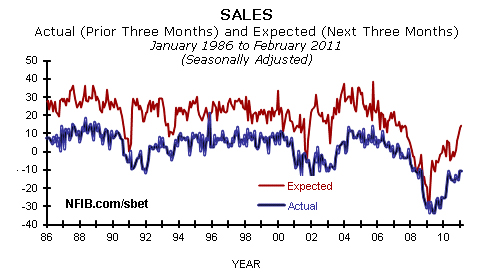

The most important factor in this morning’s report is future expectations of sales. If sales are truly rebounding then we should expect to see more hiring, more capital expenditures and continued broadening in the recovery.

“The net percent of all owners (seasonally adjusted) reporting higher nominal sales over the past three months was unchanged at a net negative 11%, 23 points better than March 2009, but still indicative of weak customer activity. The net percent of owners expecting higher real sales continued to rise, gaining one point to a net 14% of all owners (seasonally adjusted). A net negative 8% of all owners reported growth in inventories (seasonally adjusted), a two point improvement. For all firms, a net 2% (up two points) reported stocks too low, historically a very positive level of stock satisfaction. However, plans to add to inventories lost a point declining to a net negative 2% of all firms (seasonally adjusted), consistent with weak sales trends, but not consistent with the improved outlook for real sales volumes.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.