There has been a good deal of concern about stock buybacks in recent years ranging from concerns that buybacks are a poor allocation of resources to the idea that buybacks are propping up the stock market. Today we’ll investigate the idea that stock buybacks are the primary source of elevated stock prices.

A recent piece in Bloomberg stated:

Buybacks are helping prop up a bull market that is entering its seventh year just as investors bail out and head back to bonds.

This is a common misunderstanding in the financial markets and economics. People often assume that money “flows” from stocks to bonds (or, in the case of economics, for instance, from reserves to new loans). This is an alternative version of the “cash on the sidelines” myth where we often see permabulls trotted onto financial TV stating that all this “cash on the sidelines” will bolster future stock prices. This is wrong at an operational level, however, as money does not flow into stocks or bonds, but merely flows through stocks and bonds.

Although liquidity can be a sign of demand it is not the key determinant of financial asset pricing. As an example, you would never say that your house is overvalued just because it isn’t traded on some financial market every minute of every day. Likewise, prices in financial markets are not set by the quantity of “flows” in those markets, but by the eagerness of the buyers and sellers executing those flows. It’s as if these people who think buybacks have propped up the stock market believe that stock prices would collapse to $0 if there were no buybacks. But would that be at all rational? No, and there’s a logical explanation for why this is currently wrong.

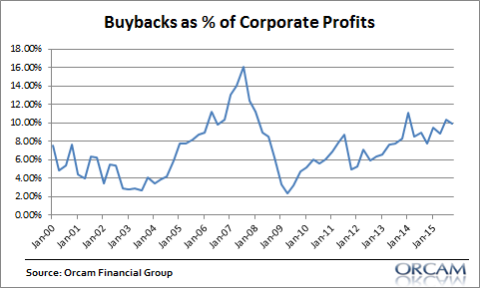

Corporations are buying back shares because their profits are near record levels and their resulting cash flows are high. Equity prices are high because future profit expectations are accordingly high. Buybacks are a procyclical result of this and do not necessarily reflect manipulated stock prices, but are merely the result of record high profits and cash flows.¹ In fact, as a percentage of total profits, buybacks are not that close to the bubbly territory we saw before the Great Financial Crisis:

Corporations are buying back shares because profits are very high and they have determined this to be an efficient way to return capital to investors during a time when they have more cash than they know what to do with.² So, every time you read a headline about buybacks “propping up the stock market” you can rewrite that as “Corporate Profits are Propping up the Stock Market”. Of course, that makes for a far less sexy headline, but it’s a much more accurate description of the current state of the stock market.

¹ – Stock buybacks are highly procyclical and tend to increase as corporate cash flows increase during expansions. As a result, buybacks are better thought of as a coincident indicator correlating to the state of corporate balance sheets and not necessarily a good predictor of future price levels. This does not mean, however, that stock buybacks will not peak with stock prices. In fact, as a coincident indicator we should expect this.

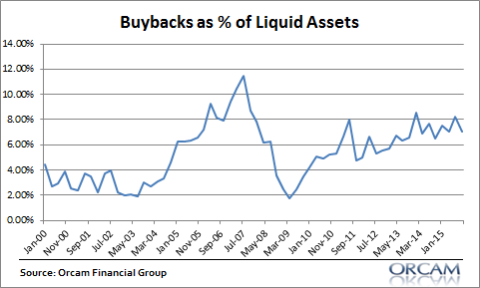

² – Some people might challenge the use of profits here, which is reasonable. Buybacks as a % of liquid assets tells much the same story however.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.