The worries over inflation seem to be never ending and while it’s clear that there’s an increasing risk of cost push inflation via oil prices, many indicators are now pointing to moderate inflation at best. The most recent CPI data showed signs of disinflation, the ECRI’s latest reading on their future inflation gauge showed a new low (which Lakshman Achuthan said was indicative of “subdued” inflation) and the ISM price index is in contraction range at 45.

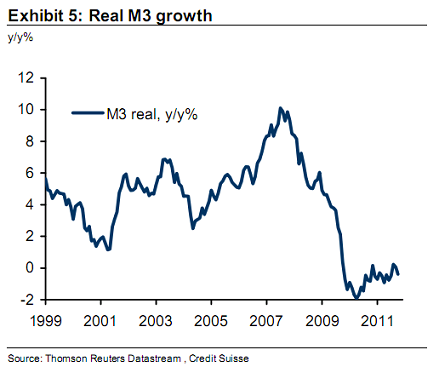

Although there’s been persistent fears about the monetary base explosion in recent years and endless hyperinflation predictions based on a mythical idea of how the banking system works, the broader money supply has also remained subdued (the Shadow Stats M3 composite is showing below trend growth of ~3% YoY). And that’s not only a USA phenomenon. We’re seeing signs of a full blown deflating money supply in Europe:

So where’ the inflation coming from? As I’ve been repeating for the last few years, it appears to be largely a China phenomenon. While most economists are busy griping about the “irresponsible” Fed and ECB, they seem to be missing the one central bank in the world that is beyond reckless – the People’s Bank of China. The PBOC has been cranking out money supply growth at double digit rates for a decade now. M2 (the broadest aggregate published in China) has been growing at an average pace of 17% per year over the last 15 years! As they build cities in the middle of nowhere and implement the greatest central planning scheme ever known to man the printing press has been red hot. And this endless printing has no doubt had an impact on commodity prices. After all, there are few people in the world who would question the commodity demand story in China.

Americans have a tendency to focus too much on their own backyard when viewing broad economic trends. When viewing the inflation trends it’s best to recognize that we reside in a global economy and that the problems in the economy aren’t solely due to poor US government actions. The broad global inflation trends point to a clear bifurcation where the developed world is obsessed with austerity and the emerging world is printing beyond imagination. While I don’t agree with much of what the Fed has done over the last few years, we should be more careful about hyperbolic rhetoric that implies that the Fed is driving us into a ditch. If anything, the Fed is the baby in the backseat with the toy steering wheel and mom and dad (Congress and the Treasury) actually believe the baby is the one controlling the car….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.