Greg Ip had a piece in the Wall Street Journal yesterday discussing the debt burden in the USA and how low interest rates have “moved back” the “hands on the doomsday debt clock”. The article touches on the important topic of entitlement spending and whether it’s sustainable, but does so in a manner that misleads readers about why this might be a problem.

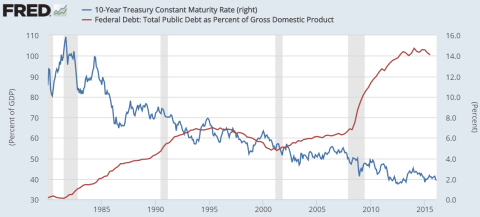

For instance, Ip says that “higher federal borrowing puts upward pressure on interest rates”. This is classic “crowding out”, an argument that has been thoroughly debunked in the last 20 years as interest rates have fallen despite soaring government debts around the globe.

(Higher interest rates are correlated to higher government debt?)

But the interest rate burden is a more common misconception. In “The Biggest Myths in Economics” I elaborate on this:

“The interest burden in the USA is actually declining as a % of GDP and is entirely controllable if the government desires. We pay about $250B in debt service every year. The Federal govt could actually reduce this substantially by reducing the maturity on their debt by issuing short-term debt instead of higher interest bearing long-term debt. They have complete control over their interest costs if they so desire.

There is no ironclad law that forces the US govt to raise interest rates if it doesn’t want to. Just look at Japan where interest rates have been zero for two decades. A government that is sovereign in its currency, has no foreign denominated debt and a central bank that can issue its own currency does not have to worry about someone else telling them that they need to raise their interest costs. This interest cost is not controlled by “the market”. It is controlled by the monopoly supplier of reserves to the banking system (the central bank) and the Treasury which dictates the average outstanding maturity of the liabilities it issues. So this too is not a realistic concern.”

Of course, the burden of inflation is a whole different problem for a government (and a very real worry). It’s highly unlikely that interest rates would remain low in the face of rising inflation, but rising inflation is certainly not an issue that appears worrisome now or any time in the immediate future. Unfortunately, we still discuss government finances as if they are precisely similar to a household. As James Montier discussed in his latest GMO piece, this just isn’t true. And putting this discussion in the proper context is crucial to understanding the cause, effect and potential risks we encounter when implementing certain policies.

See the following pieces for more detail:

- The US Government is not Going Bankrupt

- Can a Sovereign Currency Issuer Default?

- Inflation is not Necessarily Another Form of Default

- Yes, the US government can afford the national debt and rising interest rates

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.