As an entrepreneur and capitalist, I read this critique of “Keynesianism” by John Mauldin with great interest. John is a tremendous macro market thinker and someone who I’ve learned a lot from over the years. In fact, few people have done more to bring macro views to the masses over the last ten years. He deserves a lot of credit for that. But I am afraid I disagree with substantial parts of the article he wrote this weekend. In fact, I think pieces of it are based on important fundamental misunderstandings of the way our monetary system is designed and functions.

First of all, people should be careful with the term “Keynesian” (Wikipedia is not a great source, by the way). It has developed a pejorative meaning in recent decades in what reeks of political overreach usually repeated by people who clearly have not taken the time to read the General Theory. At its most basic level, Keynesian economics is a view of the world that states the following:

- Investment (as in, spending, not consumed for future production and not stock market “investing”) is the primary driver of employment and involuntary unemployment occurs when investment is lacking (for whatever reason).

- One of the primary drivers of investment is aggregate demand. In other words, businesses make most of their investment decisions based on the demand they see from their customers.

- The government can be used at points during the business cycle as a countercyclical tool to stabilize swings in aggregate demand and investment by implementing fiscal and monetary policy. This means that Keynesians can favor both reduced government policies as well as expansive government policies depending on the state of the business cycle.

Unfortunately, Keynesianism has been boiled down to one simple and egregiously misleading myth:

- Keynesians favor a permanent government takeover of the means of private production and that means they’re the same as socialists.

This is simply not the case. A Keynesian can be in favor of large government, small government, monetary policy, fiscal policy and given its central tenet of investment, Keynesians understand the importance of private businesses. It’s true that many Keynesians engage in their own form of political overreach (generally being in favor of big government all the time), but that doesn’t mean they represent the views of all Keynesians any more than Rothbard represented the views of all Austrians.

Mauldin continues by citing the famous Rogoff and Reinhart paper (a paper which I think is dangerously general in nature) arguing that government debt is necessarily unstable because the private sector controls interest rates:

“Secondly, as has been well documented by Ken Rogoff and Carmen Reinhart, there comes a point at which too much leverage on both private and government debt becomes destructive. There is no exact number or way of knowing when that point will be reached. It arrives when lenders, typically in the private sector, decide that the borrowers (whether private or government) might have some difficulty in paying back the debt and therefore begin to ask for more interest to compensate them for their risks. An overleveraged economy can’t afford the increase in interest rates, and economic contraction ensues. Sometimes the contraction is severe, and sometimes it can be absorbed.”

This is simply not true. An autonomous currency issuing nation controls the interest rates on its debt. A nation such as the USA, whose debt is denominated in a currency it can create, can always set the price of its debt. This should be abundantly clear by now as the Fed has proven that bond traders simply cannot compete with its bottomless barrel of reserves. If you think the private banking sector can move the Fed off its target rate then you’re simply not working within the realms of reality. Granted, the Fed doesn’t control the economy or the rate of inflation (which could force the Fed off its target rate), but that’s a policy decision, not one that is imposed on the government by “bond vigilantes”. Japanese bond traders have been making the same argument for the last 20 years. Clearly, there are more moving parts here than just “bond vigilantes”. (Please see here for a more thorough explanation on this point.)

I should also note that this is not necessarily a defense of government spending and government debt. Government spending and debt could potentially be very destructive. But there’s no need to create false arguments to make this point. That’s just more political overreach.

Mauldin goes on to support government spending without actually knowing it:

“I would argue (along, I think, with the “Austrian” economist Hayek and other economic schools) that recessions are not brought on by insufficient consumption but rather by insufficient income. Fiscal and monetary policy should aim to grow incomes over the entire range of the economy, and that is accomplished by increasing production and making it easier for entrepreneurs and businesspeople to provide goods and services. When businesses increase production, they hire more workers and incomes go up.”

My consumption is someone elses’s income. Therefore, it is a fundamental error to claim that a recession is caused by a lack of income instead of a lack of consumption. They are two sides of the same coin. Still, his resolution for boosting incomes is perfectly consistent with a Keynesian view of the world because the government, by definition, is increasing someone’s income when it spends more than it takes in (bear in mind, this can be achieved by lowering taxes OR increasing spending and often occurs endogenously as tax receipts decline or increase with the business cycle). This is basic accounting. The government’s deficit is someone’s else’s surplus. When the government spends more than it brings in in tax revenues then it is increasing the dollar incomes in the non-government sector. This increases business revenues via the income channel, especially when the funds go straight to business. After all, one of the main reasons corporate profits are so high is because the government has spent so much more than its income in the last 5 years (again, the Kalecki equation shows this to be true).

Mauldin is dead right when he says this:

“Without income and production, nothing of any economic significance happens. Keynes was correct when he observed that recessions are periods of reduced consumption, but that is a result and not a cause.”

Production is crucial to the economy. Keynes understood this. That’s why he focused on investment. But he also understood that production required consumption. Again, two sides of the same coin. Production matters. So does consumption. Firms need revenues to generate incomes so they can spend, invest, hire employees, etc. This is a cornerstone of Keynesian economics. Keynesian economics is not purely about boosting consumption all the time without the goal of boosting investment and production.

He continues arguing that it’s a “mathematical certainty” that you “can’t spend more than you make”. This is another error in understanding. In fact, in a credit based monetary system, households, businesses and even governments are just about always spending more than they make. Again, a very basic exercise can prove this point. If Person A spends $100 buying Person B’s widgets and saves that $100 then the total dollar spending is $100. Total output for the period is $100. Output = income. If, in period 2, Person B then saves $50 and spends $50 on dinner from Person C then total income and output have fallen by $50. If Person B had spent the total $100 then total income and output would have been $100 for period 2. The same as period 1. If, however, Person B had spent more than his/her income by borrowing $10 from the bank then he/she has spent more than his/her income and output/income has increased by $10. This is an overly simplistic view of the credit based monetary system, but two important points should be noted:

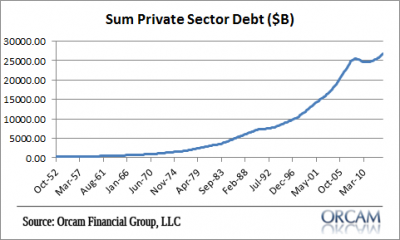

1. You most certainly can spend more than your income and over time private sector debts will inevitably increase just as they always have. In other words, as the economy grows, production expands and balance sheets improve output, income and credit will likely grow in tandem. In fact, growth will likely rely on someone spending more than their income over the long-term.

2. We do not reside in a loanable funds based monetary system where we are all fighting over some limited pool of money. The money supply, in a credit based monetary system, is elastic and can expand and contract as the supply of loans expands and contracts. This is called endogenous money because the money supply is expanded endogenously by banks who create it “out of thin air”. Banks do not compete in some loanable funds market to extend credit to their customers.

Mauldin then makes a similar error when he states the following:

“For those of you who were forced to endure Economics 101, you may remember that Savings = Investment. In any real-world economic system, you have to have savings in order to have investment in order for the economy to grow. “

I guess they don’t teach this until econ 102. But saving does not necessarily finance investment. Let’s say I spend $100 on your candy bar and you save that income immediately. Your saving is $100 if even for the briefest moment. In other words, your income not consumed is $100. If you then consume $50 on dinner then you dissave $50 via consumption. But that dissaving becomes someone else’s saving immediately. In other words, your saving does not increase aggregate saving because your spending is someone else’s saving. But let’s say a firm invests $100 in plants and equipment. The firms has not dissaved. The firm has invested. In this case, the firm has $100 in plants and equipment and the seller has $100 in new income. Indeed, it is often investment that creates saving. I assure you Keynes understood this point even if he wasn’t technically a trained economist.

I understand John’s frustration with the current economic environment and even the state of what looks like a colossally ignorant government in the USA. And as an entrepreneur and die hard capitalist I understand the desire to let capitalists and innovators do what they do best by not being chained down by an overly burdensome government. But this argument against “Keynesianism” is based on a misunderstanding of what “Keynesian economics” actually is, and worse, tries to validate that erroneous position through misunderstandings of basic economics and the structure of our monetary system.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.