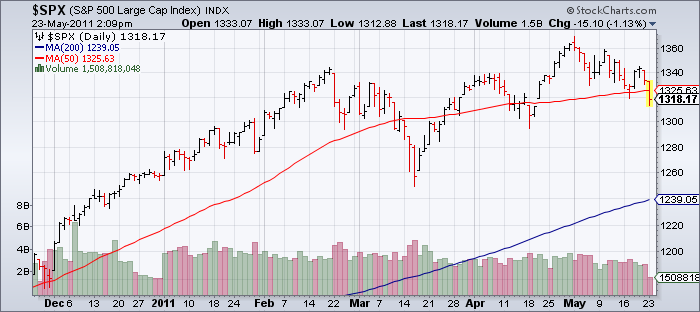

Like Richard Russell, Jeff Saut of Raymond James is keenly focused on the technical aspects of the current market environment. Saut says this is a decisive week as any break of the 50 day moving average could result in further declines:

“Two weeks ago I said, “While the intermediate/long-term internal stock market energy remains fully charged for a move higher, the market’s short-term energy still needs some time to rebuild. This probably means another week, or two, of consolidation and/or attempts to sell stocks down before we begin another leg to the upside. Even so, I don’t think any selling will gain much downside traction, implying the zone between the S&P 500’s 50-day moving average (DMA) at 1320 and the 1340 level should provide support for stocks.” Well, it’s now two weeks later and from my lips to God’s ears because the S&P 500 (SPX/1333.27) did exactly that last week when it tested its 50-DMA and proceeded to bounce above 1340, which I thought would confirm the successful test of the 1320 level. Alas, that wasn’t meant to be as once again Friday’s Fade (-10.33 SPX) left the SPX right in the middle of my 1320 – 1340 support zone. Still, the action has not negated the “call” for a move above 1400 by the end of June provided the SPX doesn’t decisively violate the 50-DMA to the downside.”

As I type, the S&P is about 8 points below its 50 day moving average. If Mr. Saut’s thesis plays out we could see a bit of a bounce at these levels, however, if the decline this week persists then it could be time to look out below.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.