James Montier never disappoints. This time he discusses how hyperinflation is “not just a monetary phenomenon” (if that doesn’t sound familiar to readers, it should). His latest note out of GMO covers the subject of hyperinflations and he’s obviously been reading MMT. He writes:

“However, there is an alternative view of hyperinflations, one that I find much more credible than the quantity-theorybased argument outlined above. This alternative viewpoint recognizes that money supply is endogenous (and hence that interest rates are exogenous), and that budget deficits are often caused by hyperinflations rather than being the source of hyperinflations.

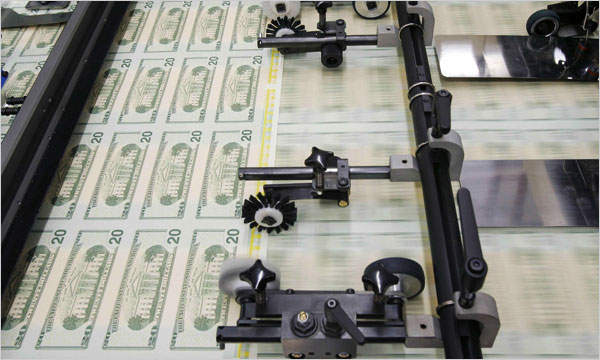

If simply “printing money” really did lead to hyperinflations, then we should expect to see hyperinflations all of the time. Any government that issues its own currency under a floating exchange rate effectively spends by printing money (as a matter of logic, if the government is the sole issuer of currency, it has to spend before it can collect any taxes at all, otherwise there is nothing to pay the taxes with). Yet, rather than two-a-penny, hyperinflations are thankfully rare events, representing occasions when populations lose complete faith in their currencies.”

Obviously, I have a bit of a beef there (though I came to many of the same conclusions on hyperinflation several years ago – see here). It’s important to understand that the money supply is almost entirely endogenous as Montier states. That is, money is created almost entirely by banks and used by everyone else. The money supply has been outsourced by the government to private banks who rule the monetary roost. This requires a more in-depth understanding than the simple idea of a “currency issuer”. As JKH has noted in the Contingent Institutional Approach, the US government, for instance, is a strategic currency issuer. In essence, the US government harnesses the banking system in what is essentially a system that bribes them to bid at auctions. The government basically leverages its enormous ability to tax the output of the private sector to have the banks do their bidding. So, banks issue the money and the US government chooses to use this bank money.

This doesn’t mean the US government is not susceptible to hyperinflation just because it has the power to tax its output. In fact, the loss or even reduction in the power to tax this output base has been the foundation for many hyperinflations. A sovereign government that cannot tax its output is essentially bankrupted (even though it will never technically “run out of money”). But again, the money supply is truly endogenous. It comes almost entirely from INSIDE the private sector. So the key here is really understanding how BANKS issue almost all of our money. In a balance sheet recession the odds of hyperinflation are extremely low because the money supply cannot expand substantially. When you combine this with an extremely advanced nation with a powerful productive base and a sovereign that can tax that output the odds of a hyperinflation are extremely low.

Read the full piece here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.