If there has been any single outstanding “upside surprise” in recent months it is the consumer rebound. This morning’s GDP highlighted the strength in personal consumption expenditures. David Rosenberg elaborates:

“The story within the story was the resurrection of the American consumer who lifted his/her spending at a 4.4% annual rate. This is the strongest gain since the first quarter of 2006, when credit was flowing freely, unemployment of 4.5% was triggering sizeable organic wage growth and rallies in both equities and housing were generating personal wealth, at least on paper. It would be a bit dangerous to extrapolate what we just saw in the fourth quarter because the QE2 juice squeezed by Uncle Ben generated a sizeable wealth effect that helped pull down the savings rate from 5.9% in the third quarter to 5.4% in the fourth (it should NOT be lost on anyone that real consumer spending at +4.4% growth managed to more than double the comparatively sluggish 1.8% annualized increase in real disposable income). Strip out this non-recurring factor and real GDP growth would have come in closer to a ho-hum 2.8% annual rate last quarter. That actually is not really that impressive for a sixth quarter of post-recession recovery, when real GDP growth is typically chugging along at roughly a 6% pace.

Be that as it may, consumers were in a buying mood in Q4 and were buying cyclical stuff like autos (+45% QoQ at an annual rate — you read that right), furniture/appliances (+11.4%), clothing (+14.2%) and recreational goods (+15.8%). Nice splurge. And if this was just a pent-up demand story, aided and abetted by the Fed’s and Federal government’s efforts to ignite a spending bounce, then it could very well be that this story is over. There is nothing in the historical post-bubble-collapse guidebook to suggest that consumer spending mounts a sustained comeback this early in the deleveraging cycle. At some point, and it could be in coming months, the government runs out of steroids

and Mother Nature resumes her course.The U.S., being the hedonistic society that it is, looks upon consumption as the ultimate source of prosperity and saving as a dirty six-letter word. While consumer spending did fabulously well, again largely on the continued “stimulative” efforts by the Fed and the Federal government, the other 30% of the economy actually fared quite poorly in Q4 — essentially stagnating (a puny 0.2% annualized growth rate). In fact, while the consumer enjoyed its fastest growth rate since the first quarter of 2006, the remainder of the economy posted its softest showing since the first quarter of 2009, when the economy was plumbing the depths of the recession. “

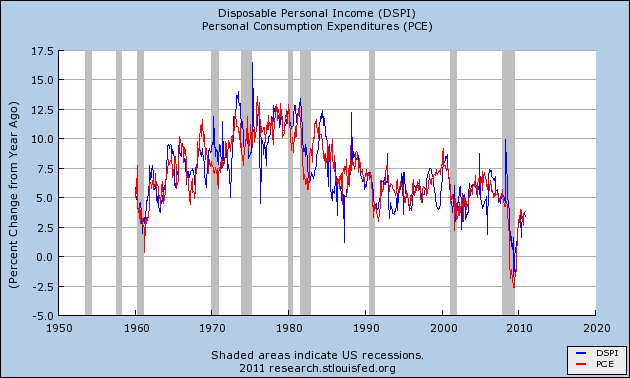

David is right on the money to a large extent. There is no doubt that the government is currently contributing to the consumer rebound in a substantial way. Not only have they placed a safety net beneath the consumer via stimulus, but they have also reduced the strains in credit markets. The balance sheet recession is alive, however, its impact has been reduced in recent months as de-leveraging slows. Combined with the rebound in corporate America and the tepid job’s growth and you have a recipe for moderate growth in incomes. Currently, disposable personal incomes are growing at 3.5% year over year. I think that’s a reasonable level to see personal consumption expenditures in the future given their near 1:1 correlation.

This quarter’s 4.4% growth in PCE is above trend and likely anomalous. Either way, it is not nearly high enough to substantially close the output gap and help the USA get back to full employment any time soon. This potent mix of government intervention and relatively strong corporations is likely to continue generating below trend growth in consumer spending. While Q4 was “better than expected” I think it’s unlikely that these trends will improve substantially without a dramatic improvement in labor conditions and/or government aid. Obviously, the latter is off the table so it’s unlikely that the above trend consumer growth of Q4 is sustainable going forward without a pick-up in hiring. For now, it looks like hiring will remain relatively weak, though positive. This all likely means some moderation in consumer spending is likely. Exogenous shocks (such as persistent house price declines) gives this some downside risk.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.