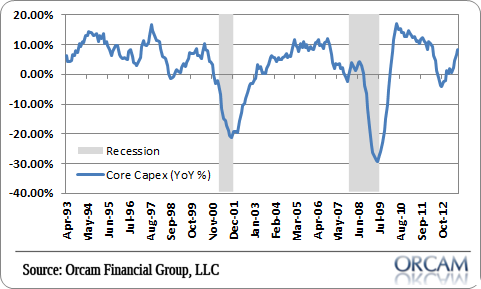

Business spending has been a real drag through the entirety of the recovery. The so-called “corporate savings glut” has left many wondering if businesses will spend and invest and drive the economic machine like they usually do. And in the midst of a slowing in government expenditures and anemic consumer spending this is a time when the business sector is much needed. So this comment from David Rosenberg’s latest really jumped out at me:

“The good news, however, was that the key leading indicator for business spending – core capex goods orders – bounced 1.5% in August. Furthermore, the three month trend of core capex orders – one of the reliable metrics gauging the US macro pulse – is running at a healthy 8.4% annual rate.”

Rosenberg’s right. This is hugely important at this point in the cycle when the government deficit is declining and the consumer still doesn’t look 100% healthy. For now, the trend in business spending looks very healthy. Let’s hope it keeps up because if it doesn’t it’s likely that the economy won’t hang in there for long.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.