Month on month inflation turned negative for the first time in 12 months and full on disinflation came back to the headline CPI figure this month as energy prices have been hammered over the last few months. As I’ve noted previously, the headline figure is being excessively dragged around by the big swings in energy prices. I had expected the headline to remain firm as the year over year comps with last year’s big spike become increasingly difficult, but I didn’t build a 30% collapse in fuel prices into that model! Welcome to the world of forecasting.

More importantly though, the core CPI reading has remained fairly firm. While the headline has fallen to 1.7%, the core is still above the Fed’s comfort range at 2.3%. The Fed’s target is 2%. The odds of QE3 at the June meeting have certainly risen, but I am sticking to my guns on the call for no QE3 at this meeting. We might see an extension of Operation Twist and a change in language, but I don’t think the current inflation readings are making the Fed that much more comfortable. The headline catches all the attention, but the core is what the Fed is reading.

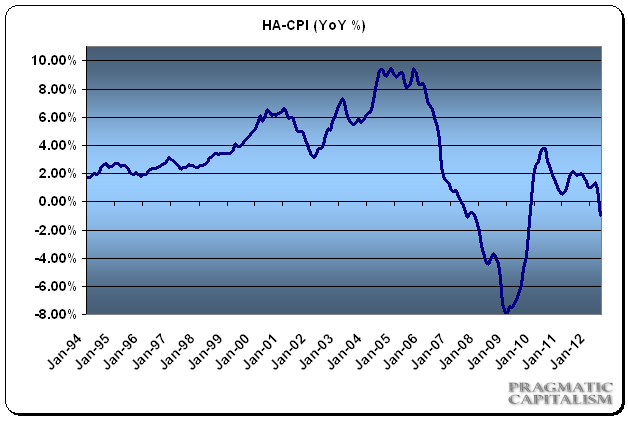

A more disconcerting development is the full blown deflation that crept into my housing adjusted CPI this month. At -0.95% prices are now declining year over year. This is the first negative reading since late 2009. This has been a fairly good leading inflation indicator over the last 10 years and the current negative reading is certainly indicative of a very weak economy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.