This morning’s CPI report didn’t provide a whole lot of clarity on the direction of future inflation. The headline figure came in at 1.5% year over year while the core figure came in at 1.9%. Both were down from previous readings of 2%. That’s still a disinflationary environment (a falling rate of inflation) for those keeping track and still consistent with a sluggish economy. That’s kind of surprising given some of the recent economic data in the USA which has been improving.

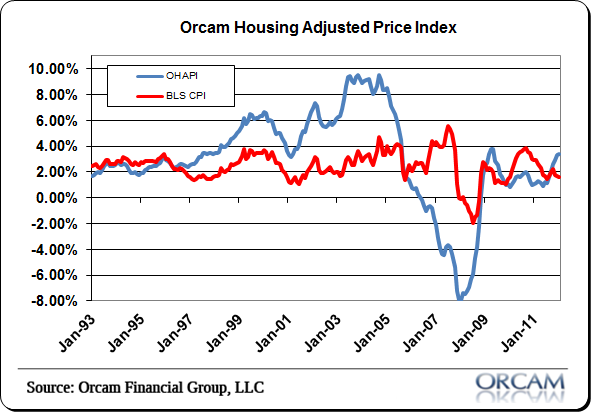

The Orcam Housing Adjusted Price Index came in higher at 3%, down from 3.6% last month (see figure 1). The big surge in year over year house prices has had a dramatic impact on the index. We should see another month or two of high housing price figures before the year over year comps start to bite. Still, this index has tended to lead the government’s CPI data so I still think inflation pressures are at risk to the upside.

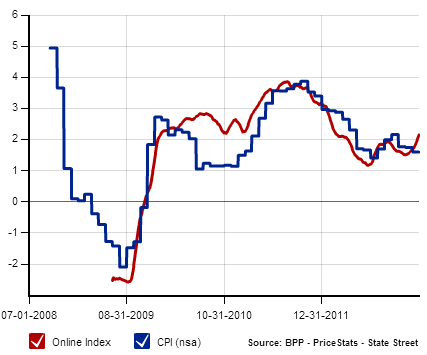

This view is also confirmed by the Billion Prices Index which has risen to 2.2% in recent readings and clearly trended higher than the CPI data (see figure 2).

None of this leads me to believe that high inflation is a problem at present. By almost any metric, inflation can be described as benign at present. I’d say the risk is presently to the upside, but the trend is certainly not very clear in the continuing muddle through economy.

(Figure 1 – OHAPI via Orcam Investment Research)

(Figure 2 – Billion Prices Index)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.