Headline inflation ticked lower this month to 2.6% while the core continued to press higher to 2.3%. The devil is in the details though. The headline is being compressed by very difficult year over year comps with last year’s big energy boom in Q1. April 2011 was when energy prices peaked last year so we’re likely to see more of the same in the next report. The headline will appear depressed, but the ex-energy component will likely tell the true story. It’s an interesting dynamic because many of those who continually cry about the headline rate will now point to the core’s rise as a sign of inflation fears. But while inflation is on the rise it’s hardly becoming a major concern.

Perhaps more importantly, the 2.3% core rate is likely to keep the Fed at bay with regards to future stimulus. They’ve been very clear about their position on this – with the rate over 2% they’re hesitant about further stimulus. With signs of recovery and higher inflation the Fed is growing increasingly wary about exacerbating any upside in inflation.

I think inflation is likely to tick higher in the coming quarters particularly at the headline rate (with the exception of next month) because the comps with energy will become very low. I would not be surprised to see a headline rate over 3% and approaching 3.5% by the end of this summer.

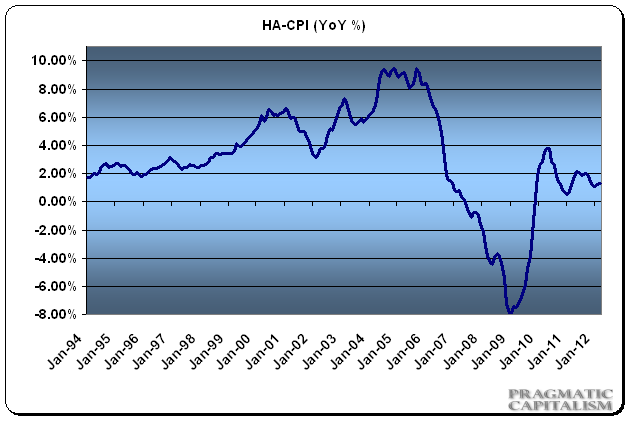

My housing adjusted CPI is even lower than the BLS report. At 1.3% it has been consistently depressed and shows no signs of inflation worries. This is not surprising given the continued sluggish economy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.