Apologies for being a week late on the inflation update, but I’ve been swamped with other things. The latest readings on CPI showed a continued trend in disinflation at the headline level but a small rise in the core level. All in all the headline figure of 2.9% and core reading of 2.3% are still low although the 2% core level is above the Fed’s comfort zone. Food, transportation and apparel all posted close to 5% gains on a year over year basis. Clearly, the fuel issue is emerging again this year as it tends to do during this seasonal period. Gasoline prices are already up 24% this year and will continue to pressure the headline reading.

My prediction of disinflation turned out to be right, but now has very little downside and we’re likely to see sideways to higher inflation readings given recent trends. I think this puts the kabosh on QE3 as I had previously expected it to come in June. With core over 2% and headline likely to creep higher in the coming months there’s no way the Fed can be expected to be even more accommodative.

The fuel issue is a real concern as this will likely dampen economic growth later in the year. Fuel prices are at records for this time of year and we generally see steady fuel prices through the winter and into the summer driving season. It would be highly unusual for fuel prices to put in a top before the July 4th holiday. Given all of the above I am beginning to think that inflation is a bigger issue than the Fed is currently expecting. Consumer credit has picked up, the deficit remains large, and we’re beginning to see some signs of stability in the labor market. We’re by no means going to see soaring inflation in the near-term (unless oil prices really kick into high gear), but it’s becoming clear that the risk to inflation is now on the upside.

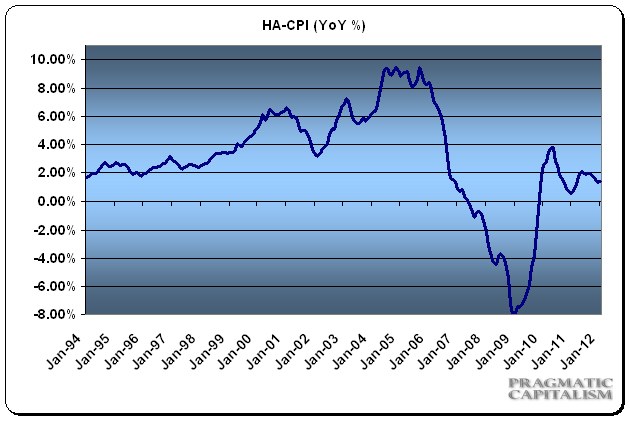

As for my housing adjusted CPI – prices remain muted on the whole as the housing market has continued to soften. But this too is likely to bottom out given the recent improvement in housing data. The latest reading was just 1.6% on a year over year basis, but I would expect that to scoot higher into year-end. All of this makes me wonder – is the Fed behind the curve?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.