There’s been a lot of push back against some of my recent commentaries about the hyperinflationists and global inflation (see here). First of all, inflation is calculated using a basket of goods. So, when I change my Orcam Housing Adjusted Price Index, to account for housing, then it’s useful to consider both the index WITH housing and the index WITHOUT housing since housing is obviously a volatile asset class right now. Rising home prices does not necessarily mean there is inflation because inflation is a rise in the overall basket of goods. The BLS uses the same logic when they remove food and energy from the CPI. Removing highly volatile components can provide a better overall understanding of broader price trends so cherry picking particular components does not validate high inflation claims.

Anyhow, there is very little evidence of high inflation at present. And a little bit of common sense totally debunks the idea that there is high inflation. Stick with me here.

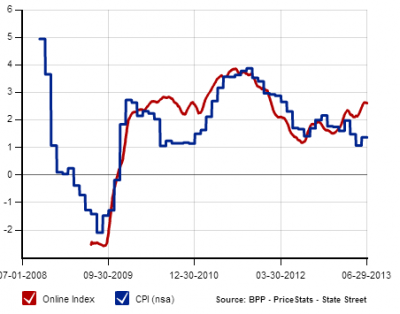

First, let’s just glance at a few of the independent inflation gauges:

The Billion Prices Prject is actually showing inflation a bit higher than the BLS. But I know the inflationists aren’t satisfied with the BPP because they say it only shows online prices and doesn’t account for other factors:

So what about the ECRI, another independent view? Again, similar story – their Future Inflation Gauge is showing just a 1.8% rise in prices:

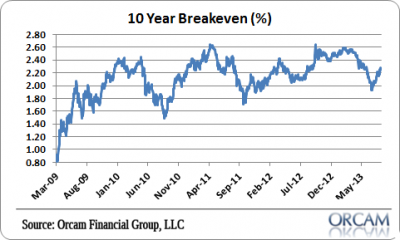

Not satisfied? Okay, what about a market gauge? If we look at the 10 year break-even rate we see a similar story. The 10 year break-even is at just 2.26%:

Still not satisfied? How about some common sense. If the CPI is much higher than the BLS says at 1.8% then that means real GDP is that much lower. So, for instance, if the CPI is REALLY at 5% as ShadowStats claims, then that means real GDP is -2%. And it basically means the economy has been contracting for the entirety of the last 5 years. But does that make any sense at all? If you believe that then it also means that all of these data points are wrong:

- ISM Manufacturing at 55 (growing).

- ISM Services at 56 (growing).

- Markit PMI at 53.2 (growing).

- Non-farm payrolls at 160K (growing).

- ADP Private payrolls at 200K (growing).

- Industrial Production at 99.05 – just shy of its highest reading since 2008.

There are plenty of other indicators showing similar trends. The point is, many of these indicators are privately issued and clearly showing consistent expansion. So, if you believe that the rate of inflation is higher than the BLS reports then it must mean that the government is not only lying about the CPI, but they must also be lying about nominal GDP. Either that, or all of these private companies are in collusion with the government to make it appear as though the US economy is growing when it’s not. It’s fine if you believe that, but don’t expect anyone to take you seriously.

And courtesy of reader of LVG:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.