By now it’s pretty clear that the economy makes the world go round. If people don’t have jobs they’re not happy. And people don’t have jobs when the economy stinks. Politicians know this. We can bicker about Social Security and wars abroad, but at the end of the day the voters care primarily about one thing – if the economy is prosperous enough to provide them with the ability to create a better life for themselves and their families. It’s that simple.

Unfortunately, politicians don’t really care about the long-term. They care about getting elected. And elections occur only in the short-term (at least when compared to business cycles). So they tend to implement policy that will help them achieve their short-term goals. Often times the result is an obvious conflict. We sacrifice the long-term well-being of the country for the short-term. We do things like bailout bankers and implement silly stimulus packages that are targeted at short-term fixes (homebuyers tax credits) and not structural problems (infrastructure & jobs).

So, today I am putting my Republican campaign strategist hat on. What could we do to ensure that President Obama gets kicked out of the White House in 2012? Well, the obvious answer is that we want to make the economy really stink no matter what. We want the unemployment rate to remain high so we can run advertisements non-stop that say:

“The unemployment rate is higher today than when President Obama took office!”

That will resonate with people. Who cares if people are really out of work? It will help us get elected. And that’s what matters to politicians. How can we best achieve this goal though? How can we keep the economy in a seemingly perpetual decline? Well, it’s rather simple. First, we need to understand the basics of the current unusual economic environment.

You see, when an economy has just experienced a massive debt bubble that implodes, you get an imbalance in balance sheets. We call this a balance sheet recession and its highly unusual (it’s only occurred a handful of times in developed economies over the last 100 years). The debt levels remain the same as they were when the debt binge began, but the decline in asset prices creates the imbalance. As the housing bubble grew the US economy experienced an unprecedented growth in debt. This generated an imbalance as debt levels far outstripped disposable income. This environment was sustainable as long as asset prices continued to climb, however, once prices deteriorated debtors were left with an imbalance. As a result, a balance sheet recession ensued as demand collapsed under the weight of households who preferred to pay down debts rather than spend. The impact is magnified by corporations that cut costs (read, fire workers) as demand collapses and they attempt to protect margins. Real sustainable recovery cannot ensue until the indebted sector of the economy returns their balance sheet to a state of normalcy.

The problem during a balance sheet recession is that it throws the economy into a tailspin. The indebted sector of the economy doesn’t enjoy their typical actions. They don’t spend and take on debt like they would during a normal economic expansion. And as I’ve explained many times here, that’s what is occurring today. The household sector cannot bear the weight of the recovery efforts because they are still too highly indebted. And until they have paid down their debts to a sustainable level they will remain in this funk. By my estimations that date will not come before 2013. And that’s perfect timing for our Republican candidates.

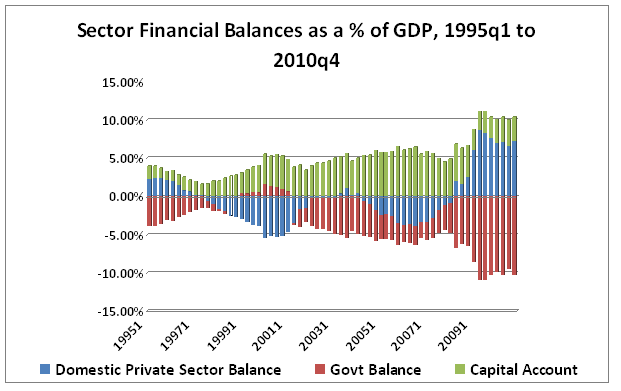

The key though, during a balance sheet recession, is understanding where economic growth comes from. Basic economics tells us that spending must come from somewhere in order to achieve growth. If everyone just sits on their wallets then there is no spending, no income, no investment and there is no growth. In the USA, that spending can come from 1 of 3 sources – the private sector, the public sector or the foreign sector. With a -3.5% current account deficit the foreign sector is out. With a balance sheet recession overhanging the private sector they are out. So, you guessed it! Spending can only come from one sector – the US government. And if they do not spend the economy will do exactly what it is doing in the lands of austerity (Greece, etc). It will sink into a hole as the private sector is exposed as being bankrupt.

This morning’s 1.8% GDP report was a fine example. The report said:

“The deceleration in real GDP in the first quarter primarily reflected a sharp upturn in imports, a

deceleration in PCE, a larger decrease in federal government spending, and a deceleration in

nonresidential fixed investment that were partly offset by a sharp upturn in private inventory investment.”

You see, what’s happened over the last 2 years is that the government has stepped in and taken the baton from the private sector. You can best visualize this in the chart below. That huge decline in the red bars led to a direct surge in the blue bars. And it’s the surge in the blue bars that added income to the private sector at a time when it was paying down debts and generally misbehaving (in economic terms). This created what looks like a “recovery”. In reality, it’s just government spending filling in the gap leftover from the private sector debt debacle.

So the key here is really rather simple. If we can cut spending we can keep the economy in a hole. And that means we can keep the unemployment rate high. We can keep people angry and scared. I propose that we use the debt ceiling as our primary tool. Of course, it’s factually impossible for the US government to run out of the money that only it can produce. And that logically means that the debt ceiling is a silly self imposed constraint to begin with (not to mention the fact that a nation with endless supply of currency in a floating exchange rate system and zero foreign denominated debt never really has an inability to meet its obligations, ie, there is no such thing as becoming “insolvent” in the traditional sense). But the voters don’t get this. They think the US government is constrained in its ability to spend. They think the US government can go bankrupt like a currency user such as you or I or Greece. If we can use this household analogy to scare people into thinking that the USA is bankrupt then we can scare people into believing that we need to cut spending. Never mind that inflation is the true constraint and that core inflation is 1.8% and headline is 3.1% (with near record gas prices!).

The bottom line is simple. We must cut government spending at all costs. We should not reduce taxes. We should not allow any more stimulus packages. We need to crash that blue bar in the above chart. And we need to utilize any and all strategies to do so. If we can achieve a collapse in government spending we can ensure a weak economy in the coming two years. And if we can ensure a weak economy we can plug anyone we want into the White House. Let’s get started.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.