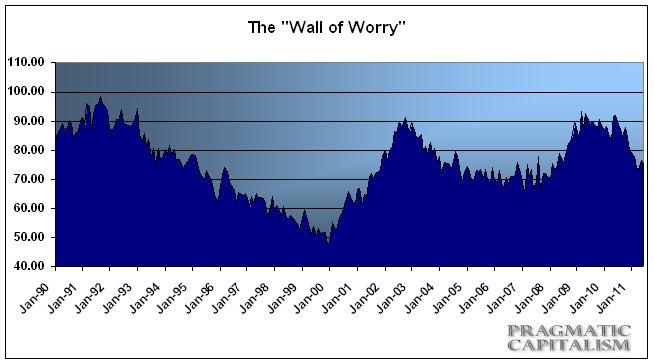

The “wall of worry” indicator, a combination of consumer and producer sentiment readings, has continued to trend lower in the most recent month despite the growing fears of an economic slow-down. The June reading comes in at 75.6 which is down from the May reading of 76.5, but up a bit from the April reading of 74.4.

Despite the downtrend, this is still a historically high level for the metric and is consistent with an environment in which long-term fears over the economy are high. During each of the last three severe economic downturns the index peaked over 90. In the go-go days of the Nasdaq bubble the index reached its all-time low of 47.6. During the 2007 credit boom the index bottomed at 65.9. A reading of 76.5 tells me that there is still substantial worry in the market.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.