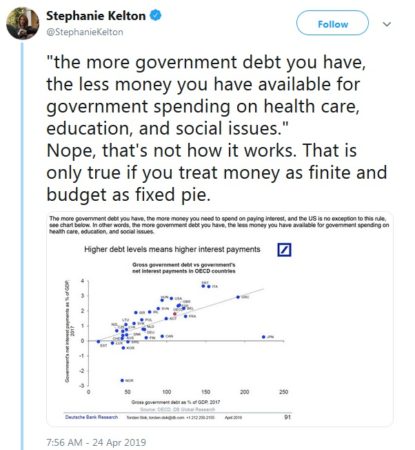

Deutsche Bank put out an imprecise piece of research saying that higher debt levels mean higher government interest payments. This isn’t really true because the government can technically set its interest rates at whatever it wants. For instance, there was nothing stopping the Fed from keeping rates at 0% forever.¹ What DB was really implying was that there is a direct connection between debt and inflation (which interest rates are primarily a function of). But this is not really a good conclusion considering that there is ample evidence that higher government debt does not necessarily lead to high inflation (eg, see the USA or Japan over the last 30 years). So, we shouldn’t claim that government debt necessarily causes inflation or higher interest rates.

This is just one end of the extremist spectrum though. For the other end see Stephanie Kelton of MMT fame who had an equally bad conclusion of her own. She said:

This is a central tenet of MMT – the idea that money isn’t a scarce resource and that government spending is “self financing”. To emphasize this point and understand how fundamentally wrong it is, it’s helpful to look at Kelton’s next Tweet:

Let’s look at one of these examples more closely. For instance, here’s a stadium that has functionally run out of points:

I know, I know. The stadium hasn’t really run out of points. As long as there are people there willing to put numbers on the board it still has points. But if you put numbers up on the board and no one’s playing the game does it really matter whether you claim to still have points? No, it doesn’t. Further, the fact that you put points on the board doesn’t mean there will be demand to see those points. In other words, government spending isn’t “self financing” as MMT often claims. This is crucial because MMT assumes that since they control the printing press they can control the demand for money that comes from that printing press in the same sense that someone might assume that a stadium controls the demand to see points on the board because they control the scoreboard.

And this is where MMT kind of falls apart with what I would say is a rather basic misunderstanding of the concept of “funding” in finance. When high inflation is raging through a country the government can still technically put points on the board by printing money, but the reason your currency is hyperinflating is, in part, because people aren’t playing the economic game with your points any more. In other words, government currencies hyperinflate when the demand for that currency collapses relative to real goods and services. This is like the stadium that can still technically put points on the board, but is no longer tracking a game that people care to watch. Just as the demand for seeing the stadium’s points has collapsed so too does the demand for government money when inflation is high. And crucially, the demand for seeing points in the stadium is a function of the quality of the underlying game just like the demand for money is primarily a function of the quality of the underlying output (something the government does not control).²

The key point is, although money is endogenous (meaning it can be created from thin air) it is in fact a scarce resource and the government can’t command control the demand for that money just because it controls the printing press and has men with guns.

NB – MMT obviously understands that the true constraint on government spending is inflation. But they misunderstand the context within which this becomes a problem and how a theoretically infinite pool of money is, in reality, very much constrained by its relationship to real resources. The point being, you don’t realize that the market for government money is nominally constrained until inflation gets very high. Then it becomes clear that the government does indeed have a limited pool of money with which it can spend into the economy without exacerbating the existing high inflation.³

¹ – There is considerable debate and evidence that this is not a good idea in the case of rising inflation, but that’s not my point. My point is that even if inflation were spiralling out of control the government could still keep rates at 0%. Whether this would make inflation even worse is a different matter.

² – This is related to the MMT concept that government spending is “self financing” thereby implying that the government can command control the demand for its money. This is no more true than the (very wrong) notion that a corporation issuing equity is “self financing” just because it issues a money-like instrument that it alone creates from thin air. And therein lies the rub. Since MMT has no coherent theory of inflation and assumes government spending is self financing they are much like a corporation that promotes equity issuance without knowing if it’s diluting existing shares and endangering the sustainability of the entity itself.

³ – Let me put some numbers on this to make it empirically evident. Let’s say the government deficit is $10T in 2020 and inflation rages to 50%. In order to maintain the purchasing power of the government’s deficit they would have to spend $15T in 2021. This, clearly, could become a feedback loop of sorts. Any sensible government would vote against spending the extra $5T in 2021. As they should. In this sense, it’s quite clear that the government becomes nominally constrained during a high inflation because it risks contributing to the inflation by running the printing press.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.