There’s usually two forms of ideological rhetoric that accompany low interest rates. The first is that the Fed has “manipulated” interest rates lower. And the second is that the Fed is “punishing savers”. Let’s take a look at each of these ideas because I find them misleading at best and hypocritical at worst.

Has the Fed “Manipulated” Rates Lower?

The first misunderstanding has to do with Fed policy and its setting of interest rates. The Federal Reserve controls the overnight interest rate. It can set this rate with precision.

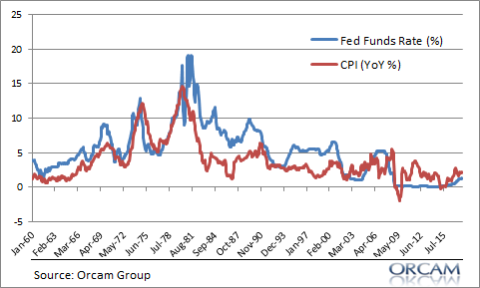

Importantly, the Fed sets the overnight rate based on the state of the economy. If the economy is weak and inflation is low then the Fed sets low rates. If the economy is strong or inflation is high then the Fed sets a high rate. We should be very clear about what’s happening here – the Fed is assessing the state of the economy and then setting rates. As you can see below the Fed Funds Rate is, at best, a coincident indicator rather than a leading indicator.

(Is the Fed chasing inflation or driving inflation?)

It’s important to understand that the state of the economy determines interest rates. And we see this across the spectrum of other instruments that the Fed does not control. For instance, the 30 year T-Bond, which is not controlled by Fed policy is also near historical lows. This is because bond investors are not demanding a high rate of return because inflation is presently low. The same is true across the spectrum of other types of bonds. The global bond market is the deepest and most liquid market in the world. While Central Banks have an influence on this market it is irrational to argue that they can control the prices in this market.

From a more operational perspective we should be clear about the Fed’s role in the overnight market where they set interest rates. The Federal Reserve is the monopoly supplier of reserves in the overnight market. This means that the Fed determines the cost of its liabilities. As a natural monopolist the Fed is a price setter, not a price taker. Therefore, the Fed literally cannot “manipulate” the cost of its liabilities. Manipulation implies that “the market” should determine the cost of reserves, but there is no “market” in reserves. The Fed supplies reserves and determines the cost of those reserves by managing the quantity and price of those reserves.

Because the reserve system is a closed system the banks within that system are constantly trying to use those reserves to lend to other banks to earn interest, however, they cannot lend them out in aggregate so this creates a hot potato effect that drives rates to 0%. Therefore, with excess reserves the overnight rate is always 0% and the Fed must drive rates UP. In other words, the Fed always manipulates the overnight rate up from 0%.

There’s a reasonable response to this – that the Fed itself is a “manipulation”. This is true of course. The Fed was created as a clearinghouse for the interbank market. But this was done to mitigate the risks caused by allowing banks to manage this process on their own. And we know from the persistent crises of the late 1800’s and early 1900’s that banks just aren’t always good at managing their risks and certainly shouldn’t be managing the payment system entirely on their own because, as private profit seeking entities, they are prone to risk taking, booms, busts and economic contagion due to their centrality in the economic system.

Some possible responses to this:

- “QE has manipulated longer rates lower!” No, it hasn’t. If QE “worked” then it would have strengthened the economy and rates would be higher.

- “The government inflation data is all wrong!” The government’s inflation data is hardly perfect, but it’s a stretch to argue that it’s all wrong. After all, if the inflation data is fake or misleading then why are interest rates across the entire bond market so low? If inflation was in fact higher then the market would demand much higher rates on bonds.

- “The inflation is all in asset prices!” – Asset price inflation is not consumer price inflation. But this misses a more fundamental point – low inflation is good for stock prices because it reduces the cost of capital and makes future income streams more stable. Stocks should benefit from low interest rates and more importantly, low inflation.

Has The Fed Punished Savers with Low Rates?

The second form of ideological rhetoric that often accompanies low interest rates is the idea that savers get “punished” by low interest rates. If you look at a portfolio of equal weight stocks, bonds and cash the total return over the last 10 years is 4.8%. A portfolio of 100% total bond market generated 4.11% per year. A portfolio of 80% cash and 20% stocks generated 2.57% per year. This includes the financial crisis! So it’s illogical to argue that savers have been punished during this period.

Of course, this isn’t what these people are usually referring to when they think of “savers”. What they really want is risk free income. And that usually comes from the US government as a function of the Fed’s policies. Ironically, these complaints tend to come from “hard money” and anti government types. And in arguing for risk free income they’re essentially asking for a handout from the US government in the form of higher interest payments from Uncle Sam. In doing so they’re arguing for a higher government deficit and debt since interest income is one of the largest expenses in the budget deficit.

There’s a more fundamental understanding here regarding asset allocation. As I mentioned in my recent speech on the state of the markets, cash is the absolute worst asset to hold for the long-term because you are guaranteed to generate a negative real return. This is true when cash yields nothing and when it yields higher rates. So a real “saver” should never have all of their savings in cash.

Lastly, these “free market” thinkers should love 0% interest rates. Not only does it set overnight rates at the natural rate of 0% (since banks will naturally bid down the cost of reserves in the overnight market), but it reduces the deficit, government debt and allows private entities to increasingly bear the burden of paying interest income to the private sector. What’s not to love?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.