Just posting this here more for reference than anything else as it’s always important to keep track of correlations for portfolio construction….(via the World Gold Council):

Just posting this here more for reference than anything else as it’s always important to keep track of correlations for portfolio construction….(via the World Gold Council):

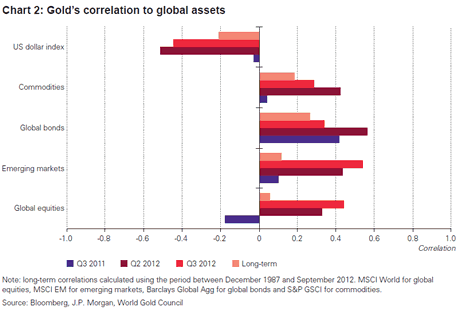

Correlation statistics between gold and other assets were similar to those experienced in Q2 2012 (see Chart 2). Its correlation to developed and emerging market equities was slightly higher than normal, but its correlation to global bonds and commodities was lower than in Q2. However, these deviations from long-term averages were not large enough to imply atypical behaviour. In prior quarterly commentaries we have shown how gold’s correlation to equities hovers around zero over the long run, but can fluctuate over shorter periods of time.

In particular, both gold and equity prices moved higher during Q3, leading to an elevated correlation. However, prices were driven higher by different underlying reactions. While both responded to monetary policy announcements and measures undertaken by central banks around the world, equities responded to central banks’ pledges to stimulate economic growth; gold, on the other hand, moved higher encouraged by factors that we discuss in the section titled “unconventional monetary policy and gold”.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.