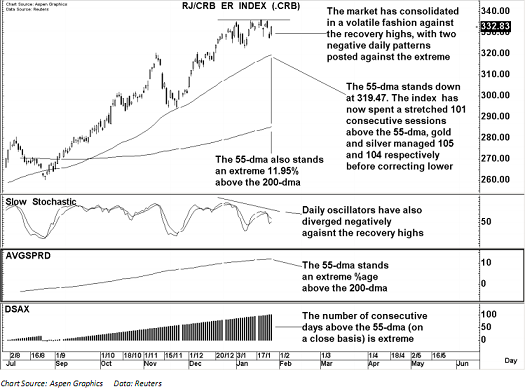

Credit Suisse isn’t the only firm calling for a more rational approach to markets. John Noyce, Goldman’s trading desk technician says there are signs of a peak in the commodity complex (via Hedge Analyst):

- The Index has been above its 55-dma for an extreme, 101 consecutive daily closes. Gold and Silver managed 105 and 104 respectively before they closed back below the 55-dma. The %age the 55-dma stands above the 200-dma is also pretty “excessive”.

- Looking back over the past decade, these are very extreme setups, but is worth noting that the CRB doesn’t have the same track record of filling the gap to the 200-dma when it does eventually begin to correct lower as Gold and Silver do on an individual basis.

- Overall, some clear warnings of an interim peak developing – or at least of the market being stretched. But ideally some further evidence is needed, like a close below the 55-dma at 319.47, before getting too excited.

Source: Goldman Sachs

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.