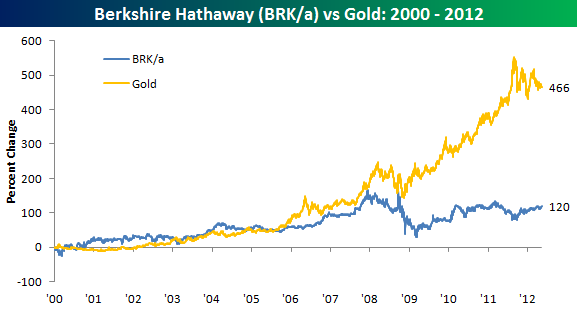

The Warren Buffett comments have ruffled some feathers gauging from the comments here at the site. And not without good reason. Among many broad generalizations that Mr. Buffett makes, one could also point to the case of “what have you done for me lately”? As Bespoke Investments points out, Berkshire has far underperformed gold since the turn of the century and not by a small margin:

“Buffett certainly has a point. An ounce of gold 12 years ago is still an ounce of gold today. But isn’t the same thing true of stock in Berkshire Hathaway (BRK/A)? Given the fact that BRK/A does not pay a dividend, no matter how much a holder ‘fondles’ or looks at their holdings, one share of BRK/A stock purchased twelve years ago is still one share today. Sure, you can sell it for more now than you bought it then, but the same is true of gold. In fact, your gain on gold is considerably more than your gain would be on BRK/A. Looking at the performance of the two assets since the start of 2000 shows that the value of gold has increased considerably more than the value of Berkshire Hathaway. In fact, with a gain of 466% since the start of 2000, gold’s gain has been nearly four times the return of BKR/A (466% vs 120%).”

Granted, there’s a mean case of cherry picking going on here, but I see the arguments from both sides….Gold is in fact money and can serve an important role in one’s portfolio. But it should NEVER be the centerpiece of someone’s portfolio.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.