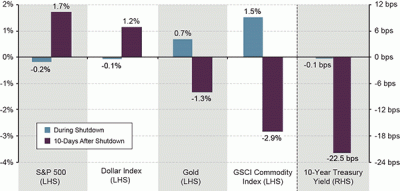

Here’s some good perspective from Guggenheim Partners regarding the shutdown and how different asset classes have tended to perform. Keep in mind these sample sets are small so the statistical validity of this can be questioned:

“There have been 17 U.S. federal government shutdowns since 1976. Excluding drastic moves in commodity prices and bond yields in the late 1970s, analysis of eight occasions during the past 30 years reveals that U.S. equities and the dollar tend to decline during shutdown periods, while gold and commodities tend to perform well. Shutdown periods do not appear to have a significant effect on 10-year Treasury yields. Historically, when a shutdown ends, market performance reverses quickly, and Treasury yields fall by an average of 22 basis points over the following 10 days.

The economic impact of a shutdown largely depends on its duration. According to consensus estimates, a week-long shutdown would cut annualized GDP growth by approximately 25 basis points in the fourth quarter.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.