FedEx, an economic bellwether reported earnings this morning. In general, the report was fairly good, but their commentary has taken a much more negative tone than we’ve seen in recent quarters. As one of the world’s largest transportation firms, FedEx is a superb indicator of global economic health. The story, according to them, is deteriorating, but not collapsing:

“Revenue and earnings increased significantly in the quarter due to strong FedEx Ground performance, improved FedEx Freight results and the continued success of the company’s yield management actions,” said Frederick W. Smith, FedEx Corp. chairman, president and chief executive officer. “While the economic environment is challenging, we remain confident FedEx will improve earnings, margins and cash flows this fiscal year.”

…”The U.S. and global economy grew at a slower rate than we anticipated during the quarter,” said Alan B. Graf, Jr., FedEx Corp. executive vice president and chief financial officer. “While FedEx Ground and FedEx Freight achieved improved operating results despite lower than expected growth, the more rapid decline in demand for FedEx Express services, particularly from Asia, outpaced our ability to reduce operating costs. We have slightly reduced our earnings forecast to reflect current business conditions and are aggressively working to adjust our cost structure to match demand levels.”

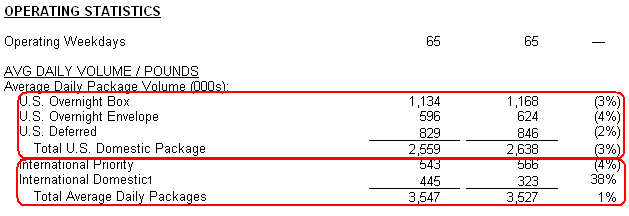

Over the last few years, we’ve been quick to point out the disparity between domestic and international economic performance. FedEx again nicely summarizes this disparity. Total US package volume/pounds declined at a rate of 3% compared to last year while international volume/pound grew at 11%.

This is just salt in the wounds of an already bad situation….

Source: Business Wire

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.