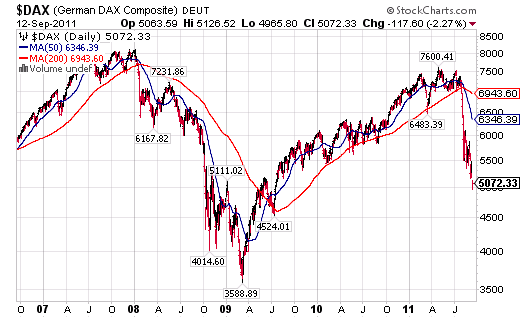

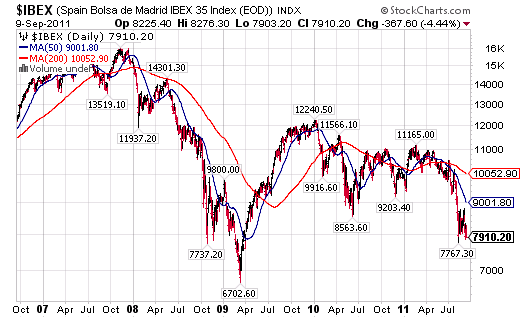

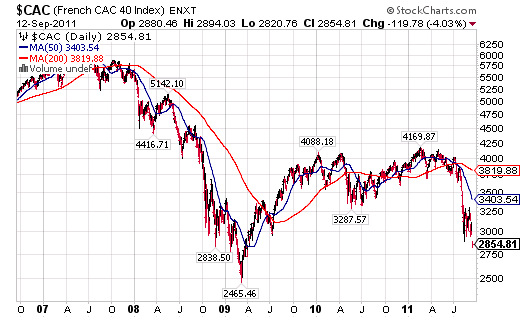

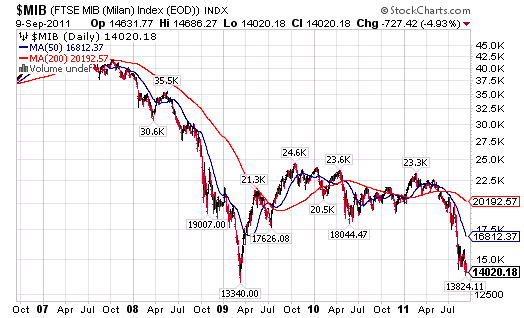

I was gazing through some charts this morning only to be astounded by how deep the losses in many European markets have been over the last few months. The USA’s S&P 500 has been a notable outperformer over the last 3 months as many European markets are absolutely cratering. For those who still think this is 2010, you might want to back out and take a longer perspective. The European equity markets are very much perceiving this as 2008 all over again with many markets fast approaching their credit crisis lows:

Germany’s DAX down -33% from “recovery” peak to trough!

Spanish IBEX down -35% from “recovery” peak to trough!

French CAC 40 down -31% from “recovery” peak to trough!

Italian MIB 40 down -43% from “recovery” peak to trough!

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.