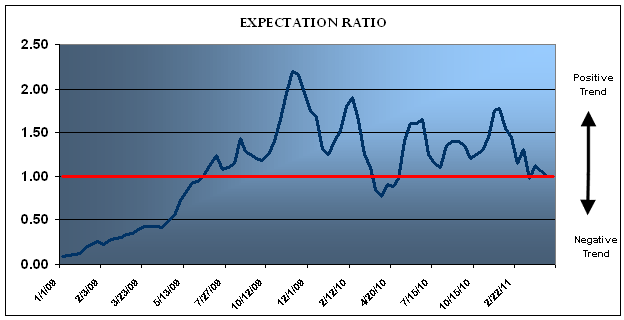

It’s been a bit of a bumpy start to earnings season. Unlike the last few seasons investors are reacting to the early reports with a rather subdued response. As I mentioned in March, the risk heading into this season was that expectations were broadly priced into the market:

“My Expectation Ratio, which measures the strength of future earnings growth compared to analyst expectations turned negative (sub 1.0) on February 28th. This is the first time the index has turned negative since March 12th of 2010. This is generally consistent with an environment in which strong earnings and robust corporate balance sheets are broadly expected and priced into shares. While the current reading of 0.97 is by no means an extreme negative it could prove to be a risk in the current earnings season if we see further deterioration. Over the course of the majority of the rally from the 666 lows the ER has remained firmly in positive (1+) territory except for a brief period preceding the flash crash. A sustained downtrend in the index would likely precede a far more challenging earnings environment.”

The ratio hasn’t budged too much in the last 4 weeks and is still telling the same story – earnings should be adequate, however, are largely expected by the market at this juncture. This is a sign that the bull market in earnings is now broadly accepted by the investment community. While it doesn’t mean shares are likely to “sell the news” or even decline, the current readings in the index does mean earnings will not likely serve as the powerful catalyst that has helped boost the market in recent quarters.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.