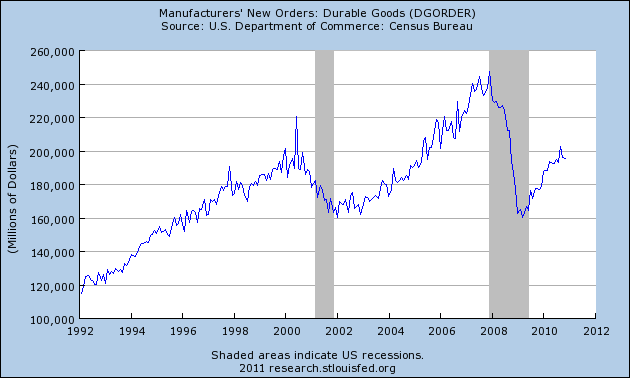

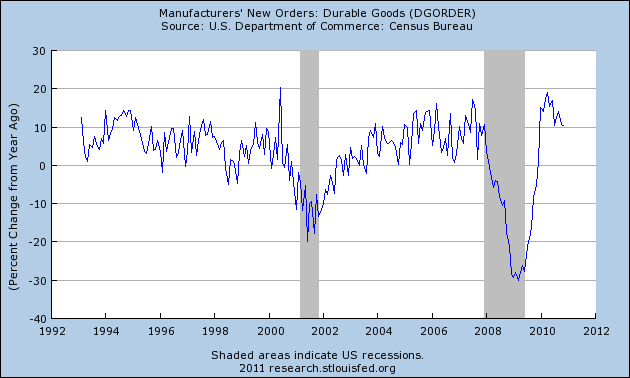

The durable goods report is a notoriously volatile economic report, however, has tended to have a fairly high correlation with equity prices over the last 20 years (see charts below). This morning’s report was weak, but nothing to panic about. On the other hand investors need to begin wondering if the slow-down in durable goods isn’t reflective of an economy that is more stagnant than some might believe. Econoday detailed the report:

“Durables orders are living up to their reputation as one of the most volatile monthly series in the U.S.-and the latest report was disappointing. Durables orders in December unexpectedly dropped 2.5 percent, following a revised 0.1 percent fall the month before. Weakness was primarily in nondefense aircraft orders. Excluding transportation, new orders for durable goods were more favorable, advancing 0.5 percent after a 4.5 percent surge in November. By industry, strength was mostly in machinery with others industries generally down but after healthy gains the prior month.

By major industries, transportation fell a monthly 12.8 percent in December after declining 13.1 percent the month before. The latest decline was mainly in nondefense aircraft which plunged a monthly 99.5 percent-again, essentially Boeing orders likely falling due to delays in its Dreamliner delivery dates. Also, within transportation, motor vehicles actually increased 1.7 percent while defense aircraft & parts fell back 10.9 percent.

Outside of transportation, strength was narrowly focused with machinery jumping 10.6 percent, after rising 0.3 percent in November. Other industries were down but generally after a notable gain the month before. Primary metals fell 4.7 percent-November in parenthesis (up 13.8 percent); fabricated metals down 1.0 percent (up 2.9 percent); computers & electronics down 1.2 percent (up 6.5 percent); electrical equipment down 0.1 percent (up 8.6 percent); and all others down 1.1 percent (up 0.8) percent.

Business investment in equipment continues to show strength outside of aircraft. Nondefense capital goods orders excluding aircraft in December rose 1.4 percent after gaining 3.1 percent the prior month. Shipments for this series rose 1.7 percent, following a 1.4 percent increase in November.

Overall, the report should be considered in light of ex-transportation showing the overall trend over two or three months. Essentially, manufacturing is still on an uptrend though one not as robust as believed last month.”

Figure 1

Figure 1

Figure 2

Figure 2

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.