The Washington Post reports that some 401K providers are considering cryptocurrencies in their portfolios. The idea that alternative assets should be more widely available has become a more and more common refrain due to the fact that many of the best performing asset classes in the last 10 years are crypto and venture capital, two asset classes that are closed off to most traditional investment accounts like 401Ks and IRAs. Should this change? Let’s explore. For the purposes of this exercise I’ll focus on cryptocurrencies as opposed to specific venture capital investments.

As you enter or near retirement most people will need this portfolio to provide a certain level of stability to offset the unpredictability that comes with reduced income streams from working. This account is compromised of your literal savings and should be allocated in a prudent manner that optimizes the likelihood of meeting your future financial goals. Importantly, as I often note, what we typically call an “investment” portfolio is really our savings portfolio. It is literally the money you save and you need it to be prudently allocated so that it creates a certain degree of predictability as you navigate the uncertainty of future liability needs.¹ If you were to think of all of your assets within a “Total Portfolio” you could divide this portfolio as follows:

Financial Assets (these are your liquid cash flow generating instruments to help meet personal financial liabilities):

- Savings Portfolio – The financial assets that finance specific future liability needs such as retirement spending (liquid cash flow generating financial assets with a high probability of future returns and principal reliability).

- Investment Portfolio – This is where you spend for future production. If you are self employed this would include any spending on your business. If you’re employed then this could include any personal spending to enhance your personal skills or side skills.

Non-Financial Assets (these are your illiquid real assets):

- Real Portfolio – the non-financial assets that you own for various reasons aside from savings and investment (real estate, gold, etc).

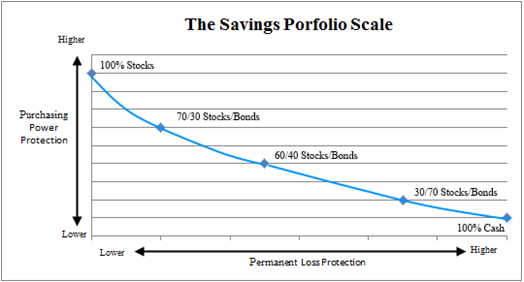

From a financial planning perspective it’s important to construct your savings portfolio in a prudent manner that is consistent with your long-term financial goals. There’s no reason why this portfolio can’t contain higher risk assets, but it needs to be balanced across time to give us certainty of liquidity needs. I talk a lot about “asset liability matching” and the need to have liquidity and predictability across certain time horizons. So, for instance, something like the stock market, in this model, is a 25 year instrument. If you needed money to pay for a credit card bill you wouldn’t allocate those funds to the stock market because they might expose you to principal risk within the next month. You can model this out across all sorts of time horizons. What we’re achieving here is diversification of assets across TIME in order to give us greater certainty across specific time horizons in our lives.

In terms of very high risk assets like the stock market or Bitcoin it’s important to keep two factors in mind as we diversify our assets across time:

- Allocation drift & risk profile variance

- Asymmetric risk of future outcomes

The Allocation Drift Problem

To highlight the allocation drift problem I am going to focus on cryptocurrencies since they highlight how extreme the allocation drift problem can become.

If you’re someone who can’t afford (or doesn’t have the risk profile) to maintain a large starting crypto position then you’re bound to suffer from what’s called “allocation drift”. Allocation drift is problematic in that it results in a non-discretionary change in your risk profile that could make the portfolio riskier than you intended. For instance, if you have an asset whose asymmetric volatility is significantly higher than the rest of the portfolio, how do you throttle that asset so that it does not dominate the portfolio and its subsequent volatility over time to keep your portfolio from turning into something that looks like a rollercoaster? The simple answer is to keep that allocation relatively small vs its volatility and rebalance. For instance, a 50/50 stocks/bonds portfolio grows to 60/40 over time because the stock volatility dominates the bond volatility. If you don’t have a risk profile for the added volatility from the new 60% equity slice then the simple solution is to rebalance back to 50% equities. I go even further at times by rebalancing even more dynamically to offset the equity risk. That is the basic premise of countercyclical indexing. All rebalancing is basically an attempt to offset the procyclical nature of the high risk assets in the portfolio to help maintain a certain risk profile that’s consistent with financial goals.

Instead of stocks let’s consider an asset like Bitcoin in this portfolio. To be clear, Bitcoin is not just a volatile asset class. It is volatility on steroids. The historical annual standard deviation of the S&P 500 is about 15%. The average annual standard deviation of the aggregate bond market is 5%. The annual standard deviation of Bitcoin is 150%. Staying long Bitcoin is like riding a bucking bronco during an earthquake. But can you throttle that bronco? Should you throttle that bronco? Can you make that initial position small enough and throttle it over time so that it doesn’t cause cash flow and behavioral problems in the future?

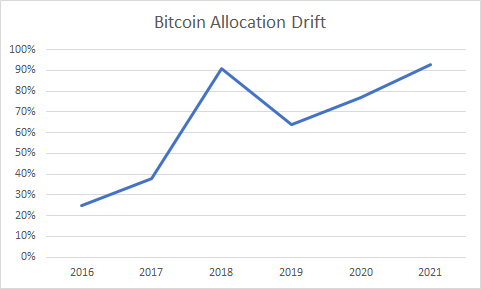

Now, to put the above volatilities into perspective I want to show you the allocation drift in a portfolio that is 25% Bitcoin and 75% Bond Aggregate. In terms of volatility this portfolio generates 95% of its volatility from the Bitcoin position because the Bitcoin position is so much more volatile than the Bond Agg. So, you’re massively overweight Bitcoin despite what appears to be a relatively small position in terms of traditional asset allocation methodologies. Specifically, if you didn’t rebalance this portfolio your allocation drift would look like this:

If we rebalance this portfolio once a year you still incur a series of 25% drawdowns along the way with 56% standard deviation. Not the worst thing in the world, but damn volatile for anyone who has a moderate or conservative risk profile. In other words, not ideal for savings and future certainty.

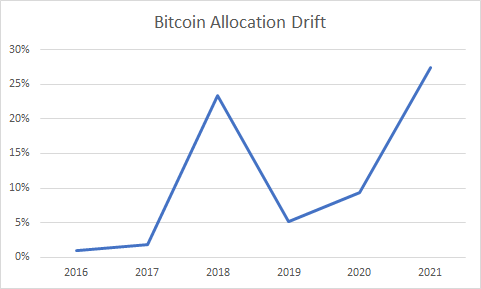

What if we reduced the allocation? For instance, I often talk about how crypto is about 1% of global financial assets. So, let’s look at a 1% Bitcoin and 99% Aggregate Bond Market portfolio. Without rebalancing that portfolio your Bitcoin allocation grows from 1% in 2016 to 28% by 2021.

In this scenario you earned 9.5% per year in this portfolio largely due to the allocation drift. Not bad compared to the 3.5% per year by owning the Bond Agg. Of course, you quintupled your annual volatility, incurred a 20% drawdown along the way and you’ve now skewed your portfolio way off its original risk profile. This is a big problem for a saver because the allocation drift exposes you to more and more potential negative volatility as the portfolio matures. This doesn’t just expose you to increased principal risk. It magnifies your behavioral risk in the portfolio since you’re now a conservative/moderate saver being exposed to aggressive style portfolio volatility.

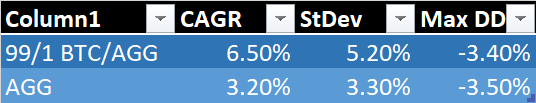

There’s an easy fix though. Rebalance. And in the case of a crazy volatile asset, rebalance very often. So, if you rebalance once every year at the end of the year then your results improve dramatically:

The basic lesson from this is that you need to rebalance aggressively to throttle the volatility of an asset like Bitcoin. Still, these are good results. It might make a moderate or conservative investor say “well, maybe I should consider a 100 vol asset in my core/savings portfolio!” Hold your horses. Let’s step back and ask ourselves, why is the 100 vol asset a 100 vol asset?

The reason the bond market has such a low standard deviation is because the bond market is boringly predictable. It’s why I love bonds. With the right bonds you know every single thing you need to know – the credit risk, the yield, the time horizon. You have every variable necessary to calculate your future risk and return. This makes bonds very convenient for conservative portfolio construction. Of course, it’s damn hard to earn a decent return in the bond market these days so you virtually have to add in some sort of riskier assets, which naturally boosts returns, but reduces future principal certainty. And that’s where things get really tricky with Bitcoin. After all, the reason it’s a 100 vol asset is because its future is so uncertain. It has fairly limited use cases, a limited history and no cash flows. With Bitcoin we know none of the variables we need to know to quantify the future risk or return.

History and the Asymmetric Risk of future Outcomes

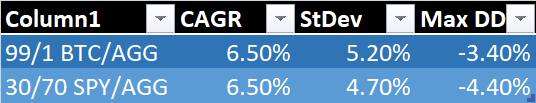

When we look at the price performance of Bitcoin it’s clear that the above volatility is very positively skewed. That’s not a bad thing. In fact, upside volatility is a good thing. What we’re worried about is the potential for sustained negative volatility. And this is where the boring old traditional financial world provides us with much greater certainty. For instance, you can construct a 30/70 stock/bond allocation that generates the same type of returns that the aforementioned Bitcoin/Agg portfolio does, but you do it using assets that have a much more reliable long-term track record:

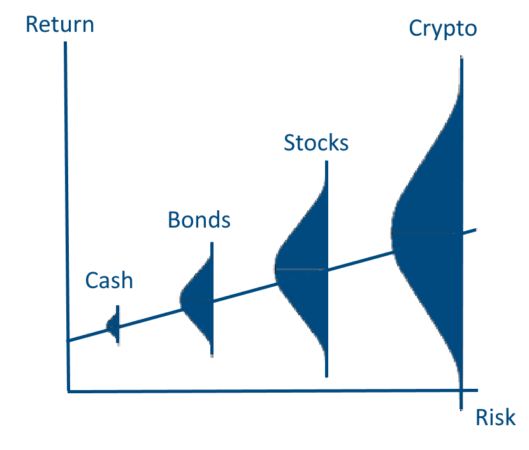

And this is where history becomes pretty important in all of this. No one has any idea what will happen with the crypto market in the future. Bitcoin could go to $1,000,000 or it could go to $0. After all, risk isn’t just standard deviation. It is the potential for variance in future expected outcomes. If we were to apply various asset classes to this view the range of potential future outcomes would look something like this in terms of risk and return:

Of course, with crypto you have asymmetric potential upside and downside. For our prior example, in the case it goes to $1,000,000 you’ve basically purchased a call option on an outlier event in your bond portfolio. If it flounders or goes down then you basically just own a bad bond portfolio. So, the moderate/conservative saver/investor has to ask themselves what’s the high probability bet here? I know, with near certainty, that a 10 year T-Note will generate a 1.6% nominal return every year for the next 10 years. And I know, with decent probability, that stocks will generate 4-5% per year over the next 30 years.¹ Should we rely on a diverse set of assets with hundreds of years of reliable performance and stability or do we rely on a new asset with limited history and limited reliability that amounts to a call option? This is a very personal question and one that requires a good deal of financial planning, but for most people the history will be an important component when matching assets with future liabilities.

This brings us back to the 100 vol reality and risk as the potential for dispersion of future outcomes. The reason a US dollar is a 0 vol asset is because you know it’s gonna be there tomorrow. $1 is always $1 in nominal terms. You get perfect principal certainty and limited purchasing power certainty. A 100 vol asset has the potential for huge amounts of purchasing power protection, but does so at the risk of enormous principal uncertainty. All the assets in the middle provide varying trade-offs between the two and finding the right blend is a personal question.

Going back to our original premise of the Total Portfolio it becomes clear that a very volatile asset class does not belong in your Savings Portfolio because they have the potential to provide you with ZERO purchasing power protection and ZERO principal protection. That’s why they’re super high volatility assets. They have enormous potential upside and enormous potential downside. Therefore, the saver/investor who considers such an asset should first ensure that they have a prudent Savings Portfolio in place and then consider these types of more volatile assets in their Investment Portfolio. Since your retirement accounts will likely be comprised primarily of Savings it is important to understand the risks of such assets before chasing past returns.

Conclusion

The argument for crypto assets in an overall portfolio has become more compelling with time. For the aggressive saver/investor and/or the saver/investor who can afford to lose this money the argument is even more compelling and a tax sheltered account would provide even greater financial planning flexibility. However, one should be aware of the enormous risks that a 100+ vol asset could pose to your actual savings. While it is likely inappropriate for the conservative or moderate investor to utilize such assets in a Savings Portfolio there is a case that a crypto or VC allocation is appropriate within the broader Total Portfolio assuming there are safeguards that protect investors from excessive allocation drift and outsized asymmetric future return risk. In other words, with a 100+ vol asset it’s always smart to defer towards the old rule “don’t allocate what you can’t afford to lose”.

¹ – From a precise economic perspective, saving is income unspent whereas investment is spending for future production. Therefore, a Savings Portfolio is generally comprised of the more reliable financial assets with an existing track record on secondary markets whereas an Investment Portfolio is more speculative and generally involves spending on a primary market with the hope of an uncertain return.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.