David Rosenberg is sticking with his long-term call on the end of the US government bond bull market, but he says we could see a near-term rally due to 4 factors:

- Treasuries are oversold.

- Sentiment on bonds is extremely negative.

- Sizable net speculative short position in bonds.

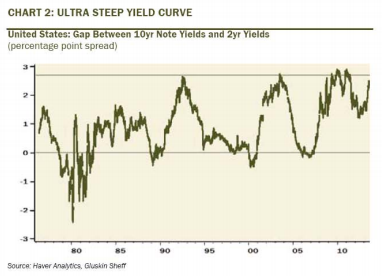

- Yield curve has hit near maximum steep levels.

Source: Gluskin Sheff

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.