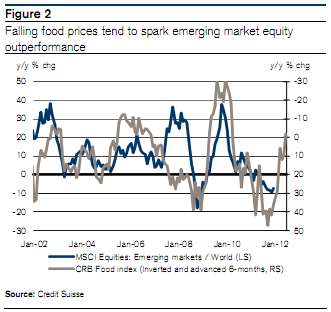

Pretty interesting correlation here uncovered by analysts at Credit Suisse. They cite the correlation between food prices and emerging market equities. Falling food prices have tended to precede emerging market equity outperformance. They cite this as one of their primary reasons to own emerging markets currently:

“Taken all this together, we recommend that investors not aggressively rush into equities right now, but use periods of near-term weakness to purchase attractive stocks in sectors/industries and also geographies we like. We particularly like stocks exposed to the capex cycle and to emerging market consumption. Moreover, besides the UK, emerging markets remain our key strategic overweight. Valuation metrics in emerging markets are undemanding relative to their developed world counterparts, particularly in light of structurally stronger economic and earnings growth potential. In addition, with inflation pressures easing thanks in large part to declining food prices, cyclical dynamics are solid. On this front, Figure 2 shows that a decline in food prices tends to lead to strong emerging market relative performance. ”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.