The recent global turmoil is a buying opportunity. At least that’s what Credit Suisse says. Their analysts are describing the recent sell-off as “no surprise” and believe volatility and downside could persist in the near-term. In the long-term, however, they say this is just another buying opportunity within a bull market and economic recovery:

“The disaster in Japan is the latest in a series of events that have induced a “risk-off” period in the global equity market. The continued uncertainty in the MENA region, Chinese inflation and policy tightening, continued concerns regarding the outlook for the periphery of Europe, and a peak in several important US and core European leading economic indicators are also making investors cautious. Importantly, these issues have emerged at a time following a solid equity market run-up over almost half a year that saw very few corrections and investor risk appetite increase substantially.

Against this backdrop, it is no surprise that equity markets have sold off so sharply in recent days. Additional near-run volatility cannot be ruled out, as markets may need to consolidate further after the sharp gains in the previous months as investors reassess the outlook. However, beyond the near term, the outlook continues to look attractive for equities. Importantly, fundamental drivers of the corporate

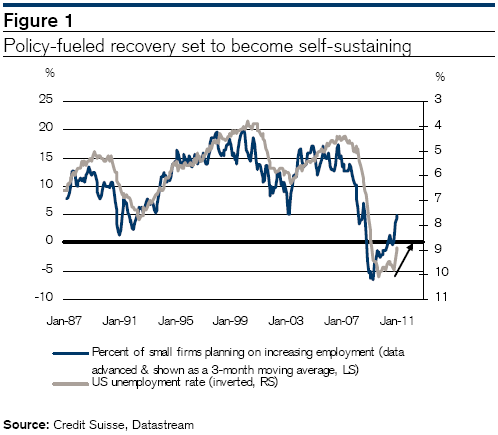

profit outlook continue to improve. Data to be published later this week may show that commercial & industrial loan demand is now expanding on a year-over-year basis – a key milestone in the post credit crisis world. In addition, forward-looking labor market indicators, including the National Federation of Independent Businesses “Net firms planning to increase employment,” suggest that the policy-fueled recovery is set to become self-sustaining (Figure 1). Against this backdrop, equity valuation metrics such as forward P/E are reasonable, and equity yields relative to those available on competing assets such as cash and bonds are attractive.”

“Equities positioning

In the near term, visibility is low. As such, we would advise those with a short-term time horizon to stay cautious. However, for investors who have a 6–12 month investment time-horizon and cash on the sidelines, we would regard further price weakness as an opportunity to add to positions.”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.